March Index Highest since June 2014

The industry clearly has been trending up since November.

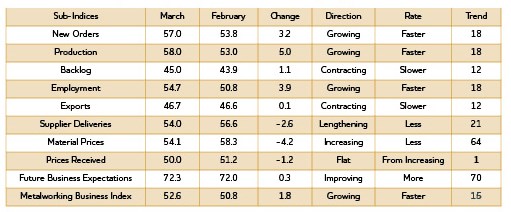

With a reading of 54.3, the Gardner Business Index showed that the production machining industry expanded for the second month in a row and at its fastest rate since June last year. The industry clearly has been trending up since November. The industry has expanded 3 of the previous 4 months. However, compared with 1 year ago, the index has contracted the previous 3 months. So, while the industry is growing, the rate of growth is not as fast as at the beginning of last year.

New orders grew for the third time in 4 months. Growth in new orders has been quite strong the previous 2 months. Production increased for the 15th consecutive month. The index has been on a significant uptrend since December, and it is at its highest level since June 2014. Backlogs have contracted for 7 months, but the index has been rising since November. Compared with 1 year ago, backlogs are contracting, indicating that the industry has likely seen at least a short-term peak in capacity utilization. Employment increased for the second month in a row, and the index was at its highest level since June last year. Exports continued to contract because of the relatively strong dollar. Supplier deliveries lengthened at their fastest rate since July 2012.

While material prices continued to increase, the rate of increase in March was its slowest since August 2012. However, the prices received index has steadily improved November 2014. Therefore, profitability at shops should be improving. Future business expectations have been generally flat for the last three months.

Plants with 50-99 and 100-249 employees saw slightly improved business conditions in March. Those with 50-99 employees are growing at their fastest rate since January 2012. But, the overall index increased primarily because smaller shops saw noticeably improved business conditions in March. Shops with 20-49 employees are growing at their fastest pace since August 2014. And, shops with 19 employees or fewer grew for the first time since May last year.

All four regions that generated enough response to the survey grew in March. The fastest growing region was the North Central – West. It grew at its fastest rate since January last year. It was followed by the Northeast, West, and North Central – East regions. The North Central – East region has grown every month but one since January 2014.

Future capital spending plans for the next 12 months contracted 5.4 percent in March. This was a significantly slower rate of contraction than the previous two months. Despite the recent month-over-month contraction, the annual rate of change has seen accelerating growth each of the previous 2 months. That is likely to change in the next month or two, though.

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)