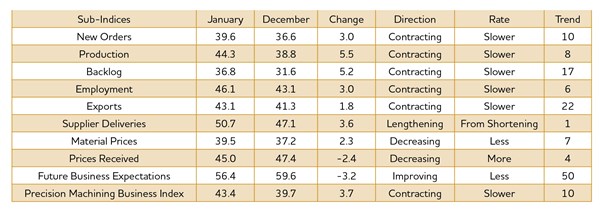

Gardner Business Index for Precision Machining: January - 43.4

Supplier deliveries lengthened for the first time since July 2015.

With a reading of 43.4, the Gardner Business Index showed that the precision machining industry contracted for the 10th month in a row. However, the index has improved notably the previous two months.

New orders have contracted 10 consecutive months. In January, they contracted at a noticeably slower rate for the second month in a row. Production contracted for the eighth straight month. Like new orders, the production index has improved markedly the previous two months. Generally, the new orders index has been lower than the production index for the previous 22 months. Therefore, the backlog index contracted for the 17th month in a row. While the backlog index had been contracting at an accelerating rate, the index improved significantly in January, indicating that backlogs contracted at a much slower rate this month. Employment contracted for the sixth consecutive month, but the index has improved since October. Because of the strong dollar, the export index has contracted since March 2014. Supplier deliveries lengthened for the first time since July last year. This indicates that activity in the supply chain is picking up.

The material prices index contracted for the seventh month in a row. The index has declined since June 2014, and it has been in a virtual free-fall since June last year. Prices received at machine shops decreased for the sixth time in eight months. In January, prices received decreased at their fastest rate since the survey began in December 2011. After improving the previous two months, future business expectations softened somewhat in January.

Facilities with more than 250 employees expanded at a significant rate in January after contracting three of the previous four months. Plants with 100-249 employees grew at a strong rate for the second month in a row. Mid-size facilities, those with 20-99 employees, have contracted at a fairly consistent rate since September. Companies with fewer than 20 employees continued to contract, but in January, they contracted at their slowest rate since September.

The Southeast region was the only region to expand in January, ending its period of contraction at three months. The Southeast was the best performing region in January as well. Every other region had an index of 44.3 or lower. From slowest to fastest contraction, the regions were the North Central-East, Northeast, North Central-West, West, and South Central.

Future capital spending plans were less than $400,000 per plant for the second month in a row. This was well below the historic average. However, compared with one year ago, future spending plans were down only 0.5 percent. This was the first time future capital spending plans contracted less than 33 percent since June 2015.

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)