October Business Index Contracts at Fastest Rate

The material prices index contracted for the fourth month in a row.

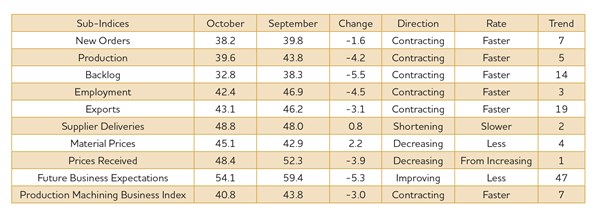

With a reading of 40.8, the Gardner Business Index showed that the production machining industry contracted for the seventh month in a row and at its fastest rate since the index began in December 2011. Other than a sharp upward spike in the first quarter this year, the index has generally trended down since January last year.

New orders have contracted 7 consecutive months, although the rate of contraction has slowed the past couple months. Production contracted for the fifth straight month. It was at its lowest level since December 2012. Generally, the new orders index has been lower than the production index for the previous 19 months. Therefore, the backlog index contracted for the 14th month in a row. It took a particularly sharp plunge this month, falling to its lowest level since December 2012. Employment contracted for the third consecutive month. This was easily the lowest reading for the employment index since the survey began in December 2011. Because of the strong dollar, the export index has contracted since March last year. Supplier deliveries shortened for the second month in a row, however, the rate of shortening was less this month. The trend in supplier deliveries indicated slack within the supply chain since suppliers were more able to meet customers’ needs.

The material prices index contracted for fourth month in a row. The rate of price decreases was slightly slower in October than the previous month. But, the index has steadily fallen since its all-time peak in June last year. The trend in the material prices index mirrors what is happening to commodity prices generally because of the weak global economy. Prices received at machine shops decreased for the third time in 5 months. The prices received index had been improving since April, but that trend appeared to be broken in October. Future business expectations have fallen significantly since July. In October, they were at their lowest level since November 2012.

Facilities with more than 250 employees expanded for the first time since May. Plants with 100-249 employees contracted at a significantly accelerating rate for the second month in a row. Companies with 50-99 employees contracted at a rate similar to the previous month. Shops with 20-49 employees had an index below 40 for the first time since December 2012. Shops with fewer than 20 employees contracted the fastest rate since August 2013.

The West and Southeast expanded the previous month, but contracted in October. Therefore, all six regions contracted in October. The Northeast and North Central-West regions had indices significantly below 40. The South Central saw its index move above 40 for the first time since May.

Future capital spending plans remained well below average. Compared with 1 year ago, they have contracted more than 40 percent in 5 of the previous 7 months.

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)