Automatic Products has a lot of experience manufacturing aircraft parts. Joel Gregory, the president of the Kent, Washington-based shop, estimates that 60% of the company’s business is from the aircraft industry, while the other 40% is comprised of other commercial industries, including aftermarket automotive, industrial equipment and underground utilities. Automatic Products makes a range of parts for several aerospace companies, including Boeing, Airbus, Bombardier and Bell Helicopter. Until recently, these parts were not supplied directly to these companies—they went through another Tier-One shop. About a year ago, Automatic Products decided to change that and started the process of gaining approval to supply parts to Boeing directly. The journey to get there was long and difficult, but the company’s leadership team says potential for growth and stability has made the process worthwhile.

Growing a Company

Production Machining first covered Automatic Products in 2006, when it was implementing a ServoCam system on its old, but reliable Brown & Sharpe screw machines. “We’ve grown in every area possible since then,” Mr. Gregory says. The company is still making many of the same commercial and aircraft parts it was making back then, but it’s now doing more of them. “We’ve added a lot more milling capabilities and started doing a lot more assemblies,” he adds. “We added five-axis milling a year and a half ago, and we just got another five-axis mill set on the floor the other day.” With that new OKK machining center, the company has a total of 15 milling machines, two with five-axis capabilities and five (including one horizontal machining center) with four-axis capabilities. Of the milling machines, 11 are located in the company’s main, 44,000-square-foot facility, which is where the bulk of the aircraft parts are made, and the other four are in a second, 22,000-square foot facility, which focuses on the commercial work. Both buildings are AS9100 certified, and although most of the aerospace work is completed in the main building, the company is starting to move some of the parts it has been running for a long time into the second facility.

This growth is what led Mr. Gregory to seek direct work from Boeing. “We’re at that point now where we have the infrastructure and people to deal with Boeing,” he says. The company’s experience manufacturing aircraft parts through other Tier-One shops has given us some insight as well. “Now we can take a project from a purchase order to a completed part and manage all aspects of product realization, from the tooling to machining, heat treating, processing, assembly and part marking.”

Business was good for Automatic Products, so it’s natural to wonder why the company would want to undertake such a challenge to change how it sends parts to a company. “It helps us spread our risk out,” Mr. Gregory explains. “Even though it’s the same company, it’s two different organizations we’re dealing with.” If work at the Tier-One shop were to slow down, it could potentially pull some of the work it sends to Automatic Products back in house. Having another source of Boeing work would lessen the impact to Automatic Products.

A direct relationship with Boeing also means longer contracts. Although the company has been producing some of the same parts for many years, the work comes through short-term or informal contracts. “I think having some long-term agreements on the Boeing side adds some stability to things,” Mr. Gregory says. “You’ll have three- and five-year contracts, so you have that work for a predictable term.”

Getting a Foot in the Door

When the company started to pursue direct Boeing supplier status, it quickly ran into a roadblock. “We tried, but had difficulty getting anywhere,” Mr. Gregory says. He realized the company needed some help, so he hired a former Boeing employee, Rick Munson, to serve in a business development role and help guide the company through the process.

Mr. Munson began his career at Boeing after college, where he served for two years as a materials buyer and three years as an external financial auditor. He left Boeing to work in sales and customer service for a machine shop, and eventually moved on to running various companies in the coatings and aerospace industries before joining Automatic Products.

“I was brought in to work with the team to get us growth,” Mr. Munson says of his role at the company, “and much of that growth is going to be through Boeing.” The contacts and connections he has maintained at Boeing throughout the years were key to getting past the roadblock Automatic Products had hit.

According to Mr. Munson, it’s difficult to become a Boeing direct supplier without a Boeing contact. “It’s not that you don’t have a great company,” he says, but without a contact, you won’t be able to get someone from Boeing to agree to sponsor you. So, when he joined the company, he started making calls to his contacts. Eventually one of his acquaintances at Boeing Portland came to visit the facility, and shortly after that the company received an application and filled it out. But that was only the beginning of the process. “The hard part is everything else,” he says.

Making a Plan

The next step for Automatic Products was to set up the infrastructure to handle direct work from Boeing, and Mr. Munson’s background proved to be invaluable at this stage. “There’s a lot of stuff you have to have in place in your system,” Mr. Munson says. “Boeing wants to make sure, first of all, that you aren’t going to fail, and second of all, that you’re going to make a quality part that’s on time.” Boeing also wants to ensure its suppliers comply with certain guidelines, including ones about being an equal opportunity employer, the company’s financials, employees, capacity and lean manufacturing practices. “They cover everything,” he says.

Mr. Munson then put together a growth plan for the company. “The company was set up for non-Boeing work, so we’re used to getting three-month contracts, not five-year contracts,” he notes. He started by listing where the company was starting in terms of sales, employees, square footage and type of work. Then he looked at some of the data Boeing makes publicly available, including production rates, deliveries and backlogs, as well as market outlooks for the aircraft industry. He also did a SWOT analysis to look at the company’s strengths (S), weaknesses (W), opportunities(O) and threats (T). “I’m trying to assess the risk of moving into a new building and putting new things in it,” he explains. Mr. Munson uses all of this information to help make decisions that will grow the company.

The company also has to be careful to not grow so fast that it becomes overwhelmed. “Boeing needs a lot of good suppliers. So if they find a good one, they can overwhelm you, and then they’ll make you a bad supplier,” Mr. Munson says. “So you have to control your growth with them.” By carefully evaluating when to bid and what prices to quote, he believes that Automatic Products can keep its growth under control.

Quality Changes

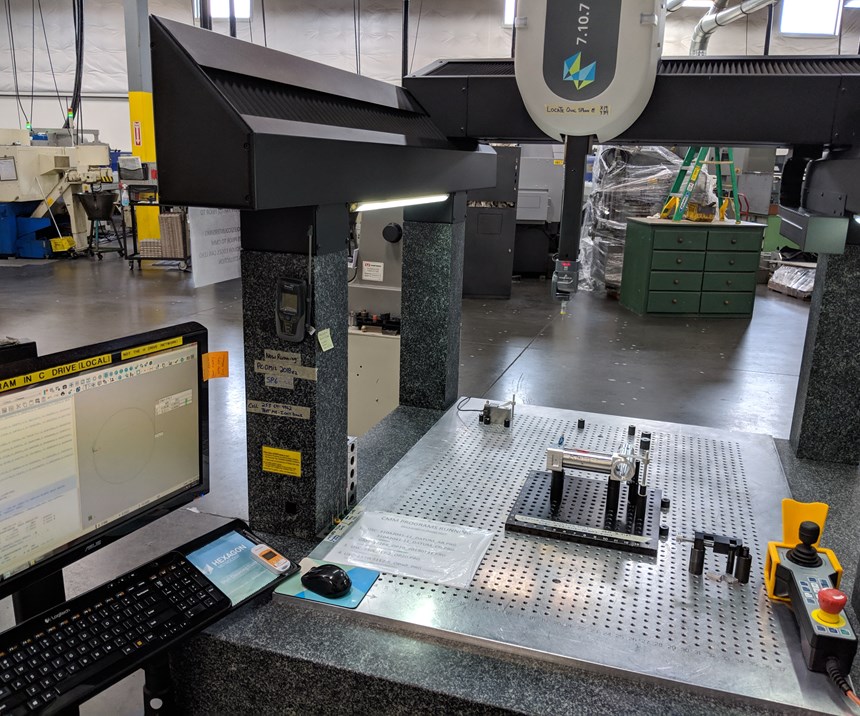

Beyond the changes to the front office, the other area of the company that has been most impacted thus far is the quality department. A Boeing supplier quality representative sent Automatic Products a list of requirements, and QA manager, Greg Rickey, got to work making the necessary changes.

“A lot of this stuff we do just by virtue of being an AS9100 company,” Mr. Rickey notes. But some of the requirements go beyond what AS9100 requires, especially the company’s digital product definition (DPD) procedures, which are specific rules Boeing has for how its suppliers handle its digital part models, from retrieval to verification. “The biggest hurdle is getting the DPD compliance,” he says.

This requires the shop to use specific software programs, which it had to purchase and implement. These include Catia for part models, Kubotek for verifying that STEP files match part models, and Net Inspect for first article inspections.

In addition, the shop has had to adjust to procedural differences. For example, customers usually send final models or STEP files, which the shop then uses to machine the parts. Boeing, however, only provides a part number. The suppliers are responsible for retrieving the models and ensuring they are accurate and up to date.

Security is also a major concern for Boeing. Automatic Products had to put measures in place to ensure that Boeing’s part files don’t end up in the wrong hands, including defining which employees would receive which type of access to which files.

The Future

Although the Boeing approval has led to major changes for Automatic Products, some things will stay the same. “We’re still doing 40% commercial, so that keeps things nicely in balance,” Mr. Gregory says. “The commercial market has saved us over the years when the aircraft industry died, and vice versa.” He adds that the company has continued to take aircraft work from the other shop since getting approval to work with Boeing directly. “We’re still doing that and that’s probably not going to change much.”

Mr. Gregory predicts that the relationship with Boeing will affect specific areas of the company. “There’s probably going to be a shift to more milling,” he says, which is a change from the company’s previous emphasis on turning. According to Mr. Munson’s estimates, Automatic Products’ work before Boeing approval was 80% turning and 20% milling, but that the new Boeing work will be 80% milling and 20% turning.

Assemblies are another likely area for growth. Automatic Products could make all component parts of an assembly and then put them together before shipping the whole thing to Boeing. “We do a lot of that now, and I see this as an area of growth for us,” Mr. Gregory says. According to Mr. Munson, these assemblies would be larger than what the company is already producing. “Boeing doesn’t have little trinkets,” he notes.

Becoming a direct Boeing supplier has required a significant investment from Automatic Products. In addition to the investment in software programs, the company has spent a significant amount of time to get to this point. The whole process has taken about a year, and many employees have had to put in additional work on top of their regular responsibilities. “But there’s gold at the end of the rainbow,” Mr. Munson says.

At the time of our shop visit, the company had just begun shipping its first commercial aircraft parts directly to Boeing and was in the process of getting long-term contracts in place. “I’m thinking we could potentially see 20% growth very easily if we can find the people,” Mr. Gregory says. And the company is already making plans to accommodate this growth—it has plans to relocate to a 110,000-square foot facility later this year.

Related Content

A Small CNC Machine Shop’s Journey to CMMC

Achieving Cybersecurity Maturity Model Certification (CMMC) — soon to be required to do work for the U.S. government — takes time and money. This 10-person shop takes us through some of the challenges it has faced and lessons it has learned on its CMMC voyage.

Read MoreT.J. Davies Retention Knobs Harden Over Time

Each retention knob is magnetic particle tested and pull tested to 2.5X the pulling force of the drawbar it is designed for.

Read MoreJR Machine Launches Expansion Strategy, Hires New CEO

An investment from Schneider Resources Holding positions JR Machine to grow in emerging markets such space exploration and green energy.

Read MoreSandvik Coromant Inserts Provide Stable Turning of Aerospace Components

The new insert grades GC1205 and GC1210 cover a large application area within last-stage machining and intermediate-stage machining when turning aerospace engine components.

Read MoreRead Next

Seeing Automated Workpiece Measurement in Real Time

User-friendly inspection software for CNC machining centers was shown at IMTS 2024 monitoring measurements between and after machining while performing SPC based on recorded measurement values.

Read MoreDo You Have Single Points of Failure?

Plans need to be in place before a catastrophic event occurs.

Read More5 Aspects of PMTS I Appreciate

The three-day edition of the 2025 Precision Machining Technology Show kicks off at the start of April. I’ll be there, and here are some reasons why.

Read More

.jpg;maxWidth=300;quality=90)