Contraction Accelerates

The lengthy contraction in backlogs, even during periods of growing new orders, indicates that there is available machining capacity at precision manufacturers.

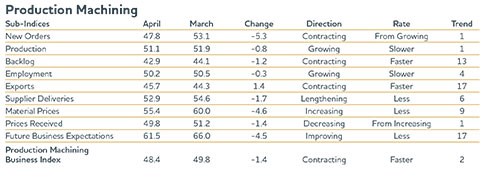

With a reading of 48.4, Gardner’s precision machining index showed that business activity contracted slightly in April. While the industry has contracted the last 2 months, it has contracted at a much slower rate than in the second half of 2012.

The real story through the first 4 months of 2013 is the diverging performance across plant sizes. Facilities with more than 50 employees have grown every month this year.

However, facilities with fewer than 50 employees have continued to contract. And, those facilities with fewer than 19 employees continue to contract at the same rate as they did in the second half of 2012. Primarily, it is small job shops that have pulled the index back below 50.0 in April.

The new orders index contracted in April, dropping to 47.8 from 53.1. This was by far the most significant reason for the accelerating contraction in the total index. Production continued to grow, but at a slower rate than in March. Contracting new orders and growing production caused the backlog sub-index to accelerate its contraction. The lengthy contraction in backlogs, even during periods of growing new orders, indicates that there is available machining capacity at precision manufacturers. Employment is still growing, but the growth has been very slow. Exports have contracted at a fairly consistent rate since the index was created in December 2011. Supplier deliveries are still lengthening, but they are lengthening at a slower rate than in March.

Material prices continue to increase, but the rate of increase has slowed significantly since January. Prices received contracted for the first time since December. This is another indication that there is available capacity at precision machining facilities. The combination of material price increases, prices received decreases, contracting new orders, and growing employment is putting pressure on profits. Future business expectations fell in April, but expectations remain above the levels of the second half of 2012.

Twice as many regions grew in April compared with March. The Pacific region grew for the third consecutive month. Also growing were the west north central, mountain and west south central regions. The east north central, middle Atlantic, and south Atlantic regions have contracted for the last 2 months. The New England region contracted in April as well.

Shops also are asked about their capital spending intentions for the upcoming 12 months. Future capital spending plans made a sharp jump in the first 2 months this year. But spending plans have fallen to just below the historical average in April.

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)