Contraction Slows Slightly

Future business expectations reached their second highest level since May 2012.

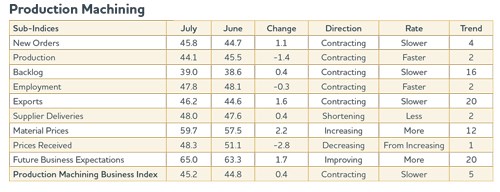

With a reading of 45.2, Gardner’s precision machining index showed that business activity contracted at a slower rate in July compared with June. This is the fifth straight month of contraction, but the first month where the contraction decelerated.

While previous months showed a bifurcation in business conditions between large and small shops, the performance difference began to moderate in June and continued to do so in July. Only shops with 50-99 employees grew in July. The growth rate in these facilities was the slowest in 2013. Shops with more than 100 employees began to contract in July. The smallest shops, those with fewer than 19 employees, continue to see poorer business conditions. These shops contracted at their second fastest rate since they started contracting in May 2012. Also, their contraction has accelerated each of the last 5 months.

New orders contracted for the fourth straight month, but at a slower rate compared with June. As new orders have slowed, production has contracted the last 2 months with the rate of contraction accelerating in July. Backlogs continued to contract, although the rate is slower than what it was for most of 2012. Employment contracted for the second straight month. The index has been on a steady downward trend since February. Exports continue to contract and have done so at a fairly constant rate since the creation of the precision machining index in December 2011. Supplier deliveries shortened, but at a slower rate. Many of these sub-indices indicate that the industry is suffering from some over capacity.

Material prices are growing at an accelerating rate, while prices received contracted in July. This should have a significant negative impact on profitability. Despite the poor performance in the industry, future business expectations reached their second highest level since May 2012. Expectations have been steadily improving since November 2012.

The South Atlantic region grew for the third straight month. The rate of growth decreased significantly in July. This has been the strongest performing region in 2013. The West North Central was the only other region to grow in July. In three of the last 4 months, its index has been at 50.0 or higher. The Pacific region contracted for the fourth straight month while the East North Central region contracted for the fifth straight month. The Middle Atlantic region remains the worst performer, contracting for the fifth consecutive month.

Planned capital expenditures hit their highest level since February. Planned expenditures were above the historical average and 5.2 percent higher than in July 2012.

.JPG;width=70;height=70;mode=crop)