Reshoring Initiative Reports Another Stellar Year

According to the report, the IRA and Chips Act combined with deglobalization trends to boost reshoring in 2022 to another all-time high — up 53% from 2021’s record.

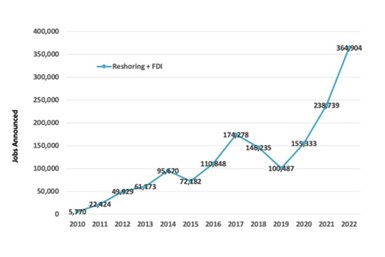

Manufacturing job announcements per year, Reshoring + FDI, 2010 thru 2022. Photo Credit: Reshoring Initiative

The Reshoring Initiative’s 2022 Annual Data Report indicates that 2022 reshoring and FDI job announcements were at the highest rate ever recorded. The fourth quarter announcements accelerated even more than anticipated due to the Chips and Infrastructure Acts, combined with deglobalization trends. A huge surge in EV batteries and chips combined with a continued trend in a broad range of industries enabled the new record.

The top report takeaways include 364,000 reshoring and FDI jobs announced for 2022, which is up 53% from 2021’s record. EV battery and semiconductor investments account for the largest increases in job announcements. According to the report, with the IRA, Chips Act and Infrastructure Bill, the U.S. government is finally warming up to an industrial policy, though a more comprehensive and sustainable plan could be achieved at a lower cost.

The report contains data and analysis on trends in U.S. reshoring announcements by U.S.-headquartered companies and FDI by foreign companies that are shifting production or sourcing from offshore to the U.S.

Report data shows that jobs announced in 2022 were a record-breaking 364,000, which is up from 238,000 in 2021. The total number of jobs announced since 2010 is now nearly 1.6 million. It is said new investments in U.S. manufacturing by domestic and foreign companies surged after President Biden’s Inflation Reduction Act and Chips and Science Act were passed.

Reshoring plus FDI have followed a strong upward trend for 13 years. The underlying trend is driven by the recognition that, in many cases, the total cost of offshoring exceeds that of sourcing domestically. There have been peaks and valleys in the trend. Reshoring in 2017 was driven by the 2017 tax and regulatory cuts. While 2018 and 2019 declined due to the trade war. The trend resurged from 2020 to 2022 driven by companies recognizing their vulnerability to supply chain disruptions and, most recently, to geopolitical events. U.S. investments in chips and EV batteries accounted for 53% of 2022 job announcements.

The initiative says that, if the current trajectory continues, the U.S. will reduce the trade deficit, add jobs and become safer, more self-reliant and resilient. But, to be sustainable, the trajectory will require a much broader industrial policy including more aggressive skilled workforce recruitment/training and a lower USD to replace momentum from unsustainable government subsidies.

For more information, read the complete Reshoring Initiative 2022 Data Report.