2017 Precision Machined Products Industry Economic Forecast

Gardner Business Intelligence (GBI) is the research arm of Production Machining’s parent company, and we gather our data from several industries that our magazines cover. As we look into this year and beyond, we see both positive and negative developments influencing the manufacturing and related industries that are important to our readership.

The precision machined products industry relies heavily on various manufacturing sectors to maintain growth and profitability, so understanding where those sectors are headed economically as well as knowing the general state of the U.S. economy provides job shops with a view of how 2017 and beyond will play out.

Gardner Business Intelligence (GBI) is the research arm of Production Machining’s parent company, and we gather our data from several industries that our magazines cover. As we look into this year and beyond, we see both positive and negative developments influencing the manufacturing and related industries that are important to our readership. The machine tool sector is recovering, and we expect it will be down only slightly year-over-year in 2017. The automotive, aerospace and medical industry are all expected to grow over the next two years. Many of the most significant industries involve international supply chains, which exposes manufacturers to the impacts of any changes in U.S. trade policies. Until there is more clarity in this area, forecasts will have to make a lot of assumptions about how trade will impact some of the largest industries served by machinery providers.

Before mentioning where we see things going from a manufacturing standpoint, it is important to define “business cycle.” Business cycle describes the growth of an economy around its long-term trend. In the U.S., the long-term growth trend has been around 3 percent since World War II. However, at any given time, the economy may grow faster or slower than its long-term trend.

Typically, each business cycle has four phases that describe how the economy is doing compared with its long-term movement (see Figure 1):

Phase 1, Early Recovery. The economy is improving from the previous recession. Prosperity and profits may be low, but are improving, and the unemployment situation is also improving. Output and production levels are stabilizing or possibly increasing.

Phase 2, Late Recovery. The economy is operating above its long-term trend. Generally, businesses and consumers are doing well and are optimistic about the economy. Output and production are high. Consumers of goods and services may see prices begin to increase more than usual. Unemployment during these times is often low. The top of this phase is known as the “peak” of the economic cycle.

Phase 3, Early Recession. The start of a recession begins as the economy slows down. The rate of consumption begins to decline, and unemployment begins to rise.

Phase 4, Late Recession. The economy is in a downturn with contracting business volumes and profit. The bottom of this phase is known as the “trough” of the cycle.

The GBI team uses statistical tools that combine the information provided by economic data along with cyclical information to build our forecasts. Because economic data is reported on a delay, we won’t have proof that we have entered a new cycle until after the fact. We expect to have that proof during the second half of 2017. The following is a combination of what both GBI and industry experts have forecasted for 2017.

U.S. Economy, in General

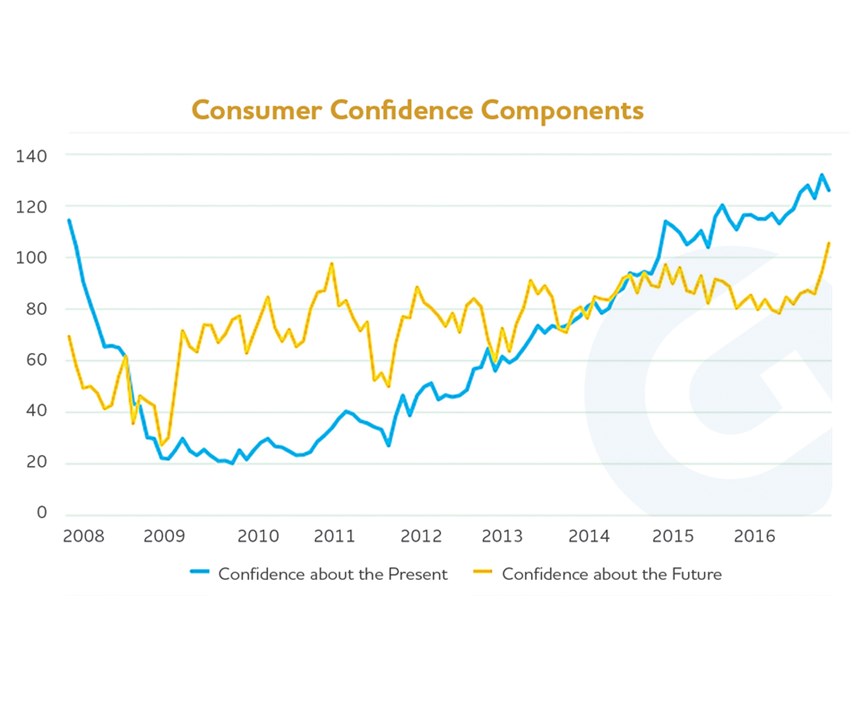

GBI believes there are several reasons to be optimistic about the economy. The U.S. Consumer Confidence Index, which is calculated as two components, is strong (see Figure 2). The first component measures the confidence in the present economy, while the second measures future expectations. It is this second measure that has increased by more than 22 percent since October 2016 and has brought the overall Confidence Index to a level unseen since before 2005. We believe that the consumer confidence is being propelled in part by the strong employment environment and signs of wage growth, both of which support our optimism for 2017.

Our outlook would not be complete without also considering credit supply and credit worthiness. On the consumer side, credit availability continues to increase, with revolving and non-revolving credit growing at almost 4 percent and 7 percent, respectively, on an annualized basis. And although the credit default rate for both consumers and businesses began increasing in 2015, these rates, by historical measure, are still manageable.

However, as America begins changing its stance toward trade, taxes and other regulatory legislation, it is difficult to perceive the direct and indirect effects of these changes and the net effect of so many policies changing so quickly and closely together. Some argue that the policies that have been or may be enacted this year will strengthen the value of the dollar, thereby diminishing the demand for U.S. exports. We are also concerned by the economic and political headwinds facing Europe and specifically the stability of the European Union. If, like Britain, additional net-contributors to the EU decide to leave, it could imperil the EU system, leading to a damaging dissolution.

Machine Tools

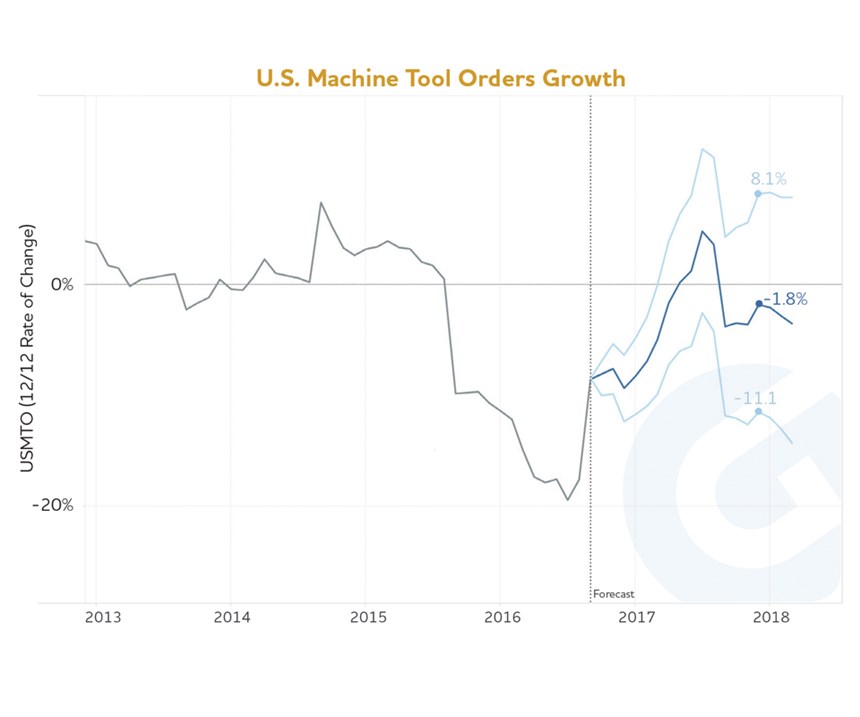

The U.S. machine tool industry, as measured by machine tool orders (USMTO), peaked at 7.4-percent growth in September 2014, and afterward experienced a trough with unit volumes down 19.4 percent in July 2016. Presently, the GBI team believes that the USMTO market is moving through the recessionary (phase 4) period and is set to experience an early recovery (Phase 1) of a new economic cycle for machine tools soon. The GBI central forecast predicts that machine tool unit orders from December 2016 to December 2017 will be down slightly less than 2 percent. On a positive note, our central forecast indicates unit order growth during the second and third quarters of 2017, before ending with a slight downturn for the year (see Figure 3). Using 1 million simulations of our data and forecast, there are 80-percent odds that the actual 2017 calendar year USMTO rate for the period will be between +8 percent and -11 percent. We expect this year’s turning machine consumption to be slightly over $1 billion, which is an increase of almost 10 percent. This increase is significant because the turning market had been in decline since 2014.

Medical

Coming off a positive 2016, revenue growth estimates in 2017 and 2018 are 4.7 and 5.1 percent, respectively, for the medical devices and instruments industry. Capital expenditures in the industry are strongly seasonal, with more capital expenditures occurring at the end of the calendar year. Between 2008 and 2016, revenues and capital expenditures across the medical devices and instruments industry have strongly grown. Certain medical sub-sectors, such as surgical appliances, have increased their capital spending during this period, growing more than 400 percent. Companies in the sector have also taken on considerable amounts of debt during the same time, which may be indicative of future growth in the industry. The surgical instruments sub-sector is also experiencing strong growth, with expectations for continued growth of 6.4 percent in 2017 and 3.1 percent growth in 2018. The forecasted numbers, however, were determined prior to the November elections. The installment of a new president and majority Republican House and Senate will likely impact the future shape of the health care system. If funding for the Affordable Care Act is cut—or if the system is substantially modified—this could have a strong impact on the medical market and the demand for downstream products and services.

The optical sub-sector is currently in a strong growth mode. The sub-sector is expected to see growth increase 12 percent in 2017 and 6 percent in 2018. Capital expenditure in this sub-sector has been growing quickly in the last 12 months.

Automotive

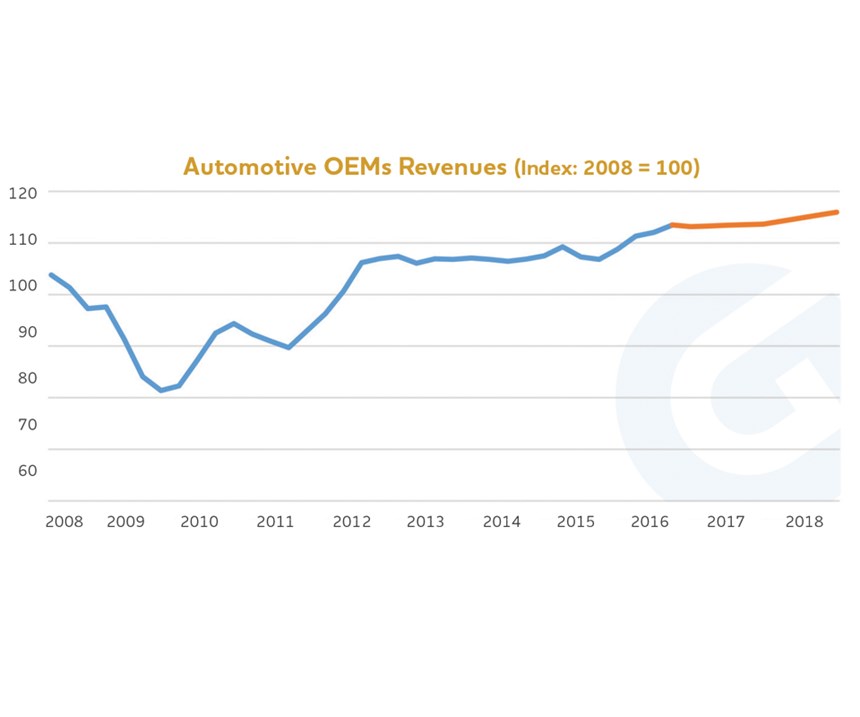

Total car and truck sales have come back close to their pre-2007 highs of 18 million units annually, with 2016 total vehicle sales reaching 17.5 million units. The annual car and truck sales from 1999 to 2007 averaged 16.8 million units.

The potential for high levels of auto sales is also bolstered by the strong financial position of the average household. Between 2009 and 2013, household debt to income decreased to levels not seen since 1980. Thus, looking forward, households have the capacity to sustain the high level of car purchases seen in the market. The increasing number of models coming to market in the next few years may create additional demand for shops in this industry. A 2-percent increase in revenues for automotive manufacturers is expected in 2018 (see Figure 4).

Aerospace

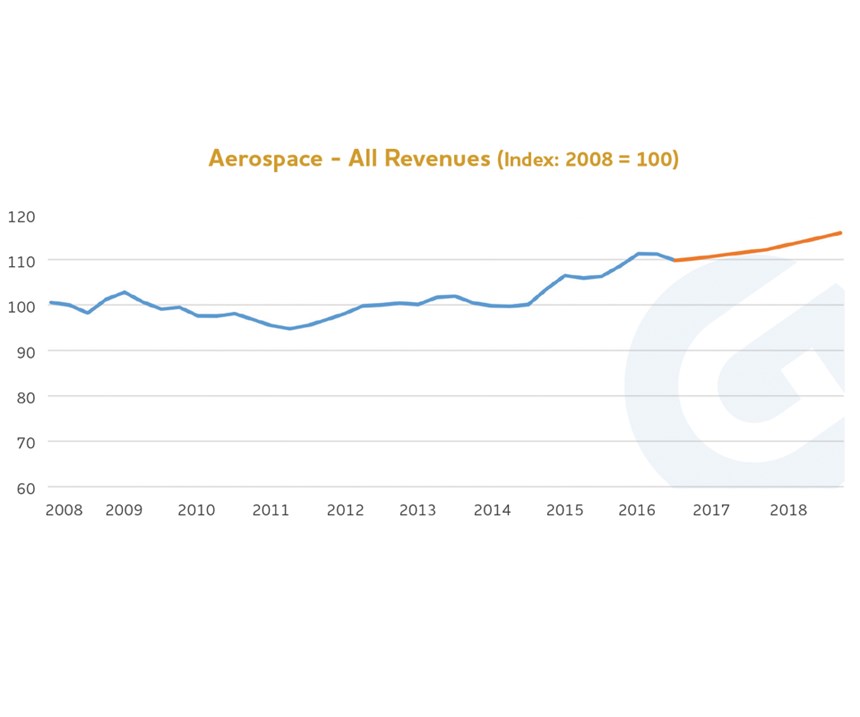

The consensus outlook from aviation equities analysts expect aerospace revenues to rise more than 5 percent during the next two years. Even without strong growth, the high level of backlog orders—valued at $1.9 trillion—will keep production plants busy. The number of players in the large commercial jet industry has increased from two OEMs in 2004 to five OEMs at present. There are 215 OEM customers representing a higher level of customer diversity than in the past. Within aerospace, the engines and parts sub-sector is also expected to see modest revenue growth in 2017 and 2018 (see Figure 5). The sub-sector outlook for missiles and space products shows strong 6-percent expected revenue growth in 2017 and more modest growth of just over 3 percent in 2018.

Closing Remarks

This article covers a range of topics and industries. Covering so much information in a small space can lead to “analysis paralysis”—when a large amount of information leaves decision makers overwhelmed and unsure of what to do or think. To counter this, one must weigh the facts. For each business owner and decision maker, the prioritization of the facts will vary by their specific situation. In general, the strength of the U.S. labor market as seen by the rise in real wages, the decrease in the unemployment rate, and strong U.S. consumer confidence provides the basis for our overall positive outlook. GBI believes these positive factors will go a long way toward overcoming, or at least mitigating, competing unfavorable market forces.

CONTRIBUTOR

Michael Guckes is senior economist at Gardner Business Intelligence, the research and market intelligence division of Gardner Business Media. He provides forecasting, modeling and consulting services to GBI clients and content for all Gardner brands. For more information about GBI, visit gardnerweb.com.

Read Next

Do You Have Single Points of Failure?

Plans need to be in place before a catastrophic event occurs.

Read MoreEmerging Leaders Nominations Now Open

Here’s your chance to highlight a young person in your manufacturing business who is on the path to be a future leader moving your company forward.

Read More5 Aspects of PMTS I Appreciate

The three-day edition of the 2025 Precision Machining Technology Show kicks off at the start of April. I’ll be there, and here are some reasons why.

Read More

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)