Beware of False Unemployment Claims Filed with Your Information

False unemployment claims are a reality during the COVID-19 pandemic. Here is a quick reference as to what to look for and how to handle it if a false unemployment claim is filed with your name.

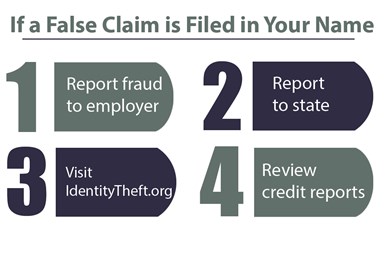

Steps to take for false unemployment claims.

The scammers of the world have found another way to take advantage of the COVID-19 pandemic by filing false unemployment claims with the names of people who aren’t filing for unemployment. According to The Employment Situation report released in August 2020 by the Bureau of Labor Statistics, the nonfarm unemployment rate was 10.2% in July 2020 which is a stark difference from the 3.7% unemployment rate in July 2019. The imposters are taking advantage of the increased workload for the unemployment agencies and, in many cases, are succeeding in receiving undue unemployment benefits.

What to Look For

The imposters are using your name and personal information to file. In addition to your name, address and place of employment, they have your birth date and Social Security number. You may not learn about the fraud until you are notified by your employer or receive a notice from your state unemployment agency. Employers need to watch their emails and notifications carefully to monitor the unemployment claims.

What to Do

According to the Federal Trade Commission (FTC), you need to act as soon as you discover the false claim and follow four steps to help protect you:

- Report the fraud to your employer. Make sure you keep a record of everything related to the fraud — emails and phone calls. Document date, time, person’s name and the discussion

- Report the fraud to your state unemployment agency. The FTC recommends filing online if possible because it will be easier to process. Document everyone you talk with and when you spoke with them.

- Visit IdentityTheft.gov to report the fraud to the FTC. This website will provide next steps to protect your credit including a free, one-year fraud alert on your credit, closing accounts if necessary and free credit reports. You can also put a freeze on your credit.

- Frequently review your credit reports. After reporting the fraud, you are entitled to free credit reports for a year, so take advantage and review often for any new fraud.

Money Mule Scam

If identity theft wasn’t enough, be aware of the money mule scam. Although the scammers will usually have the benefit payments deposited in their own accounts, sometimes the payments are sent to the person whose name was on the claim. To retrieve the money deposited in your account, the imposter may call, text or email claiming to be from the unemployment agency requesting the money “back” that was sent to you in error. Don’t believe them. According to the FTC, the state agencies would never tell you to repay the money that way. If you receive unemployment benefits in your bank account that aren’t yours, report it to your state unemployment agency right away and they will tell you what to do next.

About the Author

Carli Kistler-Miller, MBA, has over 20 years of experience with communications, event/meeting planning, marketing, writing and operations. Email cmiller@pmpa.org at PMPA.

Related Content

-

Do You Have a Quoting Process?

The only way to have repeatable results is to have a process.

-

Roles of Women in Manufacturing: What I Learned

Over 20 women were featured in the Roles of Women in Manufacturing series, which started in January 2023.

-

Onshoring Weather Report: Strong Tailwinds!

Onshoring, reshoring, nearshoring: these terms are showing up with increasing frequency in the news and online. But is there evidence that these are real?