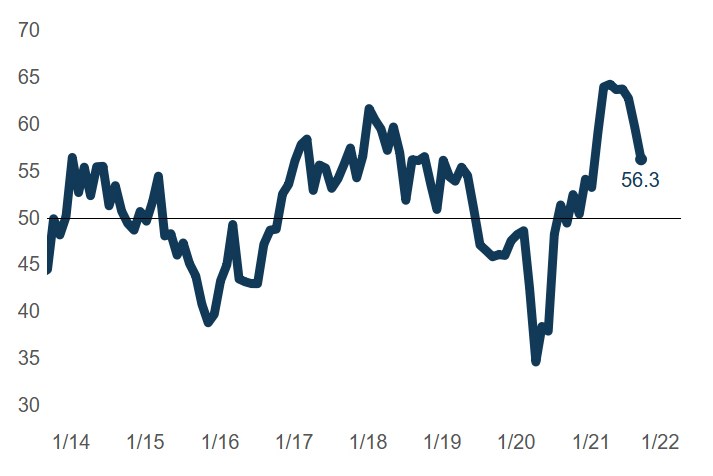

Production Machining Activity Slowed in Third Quarter

Third quarter activity was complicated by hiring and supply chain constraints

The September Gardner Business Intelligence (GBI) Production Machining Index fell by over 3 points, to close at 56.3. The decline was broad-based with slowing expansion reported for backlogs, new orders, production, and employment activity. (See last month’s reading.) The latest supplier delivery reading remained above a reading of 80 for a fifth consecutive month, signaling a persistent worsening in supply chain performance for the industry. Export orders activity contracted for a second consecutive month to its lowest reading since January.

Production Machining Index: The Production Machining Index signaled consecutive months of slowing activity throughout the third quarter.

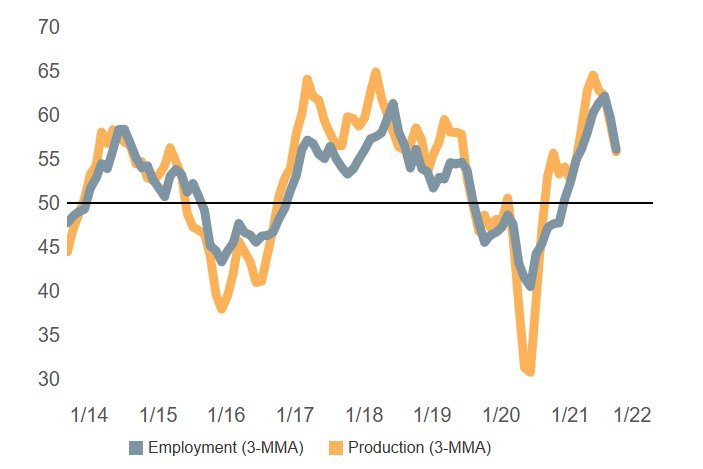

Production challenges intensified in the third quarter as month-on-month hiring activity slowed, thereby compounding problems for production activity still reeling from poor supply chain performance. Consecutive months of relatively weaker production activity relative to new orders have resulted in a production deficit, measured as the vertical gap between total new orders and production readings. September’s employment reading indicated that the proportion of production machining shops with expanding payrolls activity was hardly greater than the proportion that reported lower employment levels (with all others reporting no change). In the near-term, the ability of the industry to escalate production activity will require strategies that address both supply chain and labor shortage problems.

Slowing employment activity restraining production activity: The third quarter of 2021 saw month-on-month declines in employment activity. The simultaneous supply chain and employment challenges impacting the industry have vastly slowed production’s expansionary pace.

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)