The Precision Machined Products Industry: 2022 Was a Very Good Year

The data supports continued optimism for the precision machining industry.

The Precision Machined Products/Production Machining Industry (NAICS 332721) — including PMPA’s nearly 400 member companies — manufacture highly engineered, human safety critical, precision machined components used in advanced automotive, aerospace, defense, electrical, construction and medical technologies.

Our Industry:

- accounts for over 103,200 jobs

- has payrolls of $5 billion

- shipments of over $19.1 billion

- supplies critical components that provide functionality to a wide range of durable goods, vehicles, aircraft, medical, electrical and electronic, appliance, and defense products

- The promise of globalization has ended

- Our shops rose to the challenge

- Supply chain issues led by shipping delays, parts shortages and transportation delays due to truck driver shortages and congested ports had the greatest impact on manufacturing companies in the past 12–18 months, according to Deloitte

The promise of globalization has ended. Our shops rose to the challenge.

Supply chain issues led by shipping delays, parts shortages and transportation delays due to truck driver shortages and congested ports had the greatest impact on manufacturing companies in the past 12–18 months, according to Deloitte.

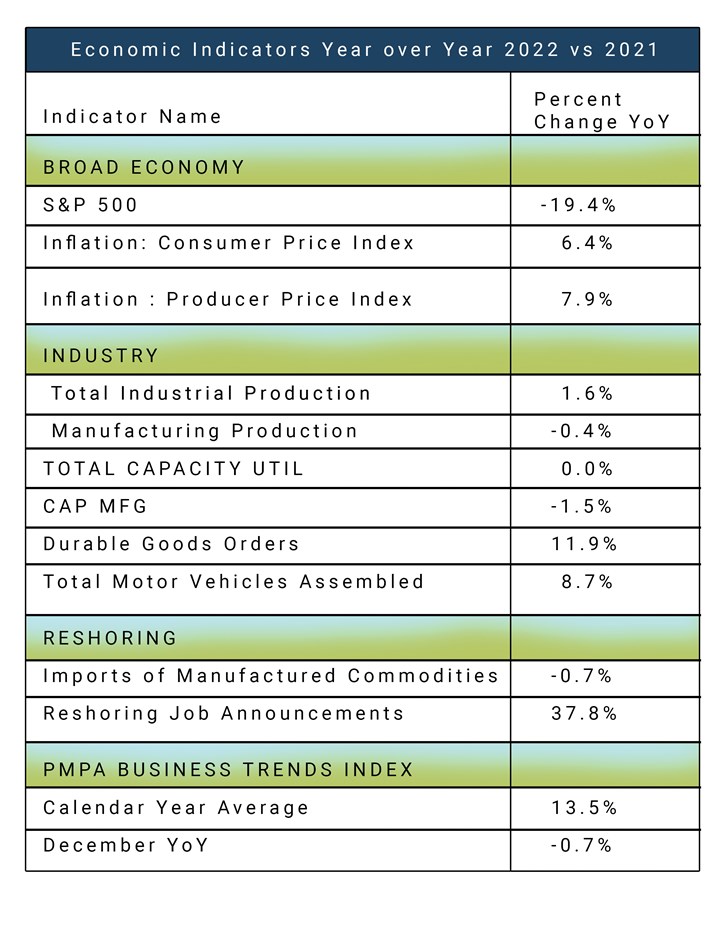

In addition to disrupting manufacturing operations and retail availability, supply chain-induced shortages led to higher inflation. Shortages of critical raw materials, commodities and components needed to produce final products drove up costs to manufacturers and prices to consumers as demand spiked. For the year 2022, the Consumer Price index (CPI) rose by 6.4%, while the prices that producers (our manufacturing companies) paid for inputs rose by 7.9%. (PMPA believes these to be significantly understated.)

Our nation needs a strong domestic manufacturing industry for national and economic security. The problems with the global supply chain were made evident to all by the COVID-19 crisis. The markets are demanding local production and reduced transportation and supply lines. The good news is that the production machining shops in PMPA were one link in the value chain of North American Manufacturing that held strong and delivered in 2022.

2022 — not a good year by the numbers to some.

A brief review of some key indicators is needed to make clear just how well our precision machining industry fared in 2022, especially compared to the broader economy.

As consumers, we see most clearly from our own experience. In 2022, we saw investments in our retirement savings plans drop in value by 19.4% ( S&P 500 data), while costs of consumer goods rose by 6.4% (CPI).

Total Industry saw costs for inputs to manufacturing increase by 7.9% (PPI), while shortages, freight delays and difficulties finding talent hampered our ability to produce. And yet total industrial production rose 1.6% compared to the prior year. Positive news! The Manufacturing segment saw its production drop by 0.4% — really not a terrible outcome while considering the challenges faced.

In manufacturing, however, there were definitely high spots — industries that actually grew and thrived in 2022. Durable Goods Manufacturing was a bright spot, with orders up 11.9% for the year. This segment has one of the best correlations to our PMPA Business Trends Sales Index, and its strong showing is a preview to our calendar year performance.

Total motor vehicles assembled is another industry segment that is heavily served by precision machining, production machining shops. Despite supply chain disruptions — everyone has heard of vehicles assembled without needed computer chips — the total vehicles assembled index was up 8.7% for 2022 (SAAR) according to the St. Louis Fed (FRED).

Because of the many precision machined components in modern motor vehicles — ICE (internal combustion), hybrid or BEV (battery electric vehicle) — the production numbers and rates for this industry also have a very strong correlation with our shops’ sales as well. So, durable goods up 11.9% and total vehicles assembled up 8.7% suggest that our shops’ performance should be equally strong — after all, our components put the human-safety critical functionality in all of these.

PMPA Business Trends Sales Index for 2022: How did we do?

Our April 2022 Business Trends Report forecast that the PMPA Business Trends Sales calendar-year average would come in at 159, up 12.8% over the prior year’s 141 average. It actually came in at 160, up 13.5% over the prior year. Our index actually exceeded the growth in the durable goods and total vehicles assembled indicators. Sales and shipments of precision machining/production machining shops — as indicated by PMPA’s Business Trends Reporting — were actually some of the most positive economics and business news of the past year. Our shops stepped up and filled in the gaps to make critical components that the supply chains were disrupting.

Why do we continue to be optimistic about this unexpected economic success for our members, our shops and our industry? Look at those reshoring statistics in the table. Imports of manufactured commodities dropped by 0.7% in 2022. And reshoring job announcements were up 37.8% in this same period, according to the Reshoring Institute.

These are convincing clues that the management of OEMs in North America now understand the need for strong domestic manufacturing industry if they are to be successful with global issues that can disrupt global shipping as well as local transportation networks. The problems with the global supply chain may not have been caused by the COVID-19 crisis, but it sure revealed them in all of their power to disrupt. The markets are demanding local production and reduction of transportation and supply lines. And, as the PMPA Business Trends Sales Index Report for 2022 shows, for our production machining/precision machining shops, the outlook remains very positive.

Correlation may not be causation, but it can show us how our actions are linked to the markets we serve. And, in 2022, our service to durable goods and total vehicles assembled and many other markets led to the most positive economic news of the year. Sales up 13.5%! 2022 was a very good year!

Read More Articles from PMPA:

- Roles of Women in Manufacturing Series: Machinists Julia Dister and Sarah Grieve

- Craftsman Cribsheet No. 114: Factors Influencing Machined Surface Finish in Our Shops

About the Author

Miles Free III

Miles Free III is the PMPA Director of Industry Affairs with over 40 years of experience in the areas of manufacturing, quality, and steelmaking. He helps answer “How?, “With what?” and “Really?” Miles’ blog is at pmpaspeakingofprecision.com; email – mfree@pmpa.org; website – pmpa.org

Related Content

Machining Unleaded Materials — Reliability is Possible

Leaded steel is no longer produced in the United States. How do shops approach unleaded brass and steel machining?

Read MoreCraftsman Cribsheet No. 129: How to Beat the Heat

Shops tend to heat up in the summer. Here are some tips for staying cool in the warmer months.

Read MoreCraftsman Cribsheet No. 128: Why Do Machinists Say Tenths Instead of Ten Thousandths?

In machinist parlance, a tenth is a tenth of a thousandth, not a tenth of an inch.

Read MoreOnshoring Weather Report: Strong Tailwinds!

Onshoring, reshoring, nearshoring: these terms are showing up with increasing frequency in the news and online. But is there evidence that these are real?

Read MoreRead Next

Do You Have Single Points of Failure?

Plans need to be in place before a catastrophic event occurs.

Read More5 Aspects of PMTS I Appreciate

The three-day edition of the 2025 Precision Machining Technology Show kicks off at the start of April. I’ll be there, and here are some reasons why.

Read MoreA Tooling Workshop Worth a Visit

Marubeni Citizen-Cincom’s tooling and accessory workshop offers a chance to learn more about ancillary devices that can boost machining efficiency and capability.

Read More