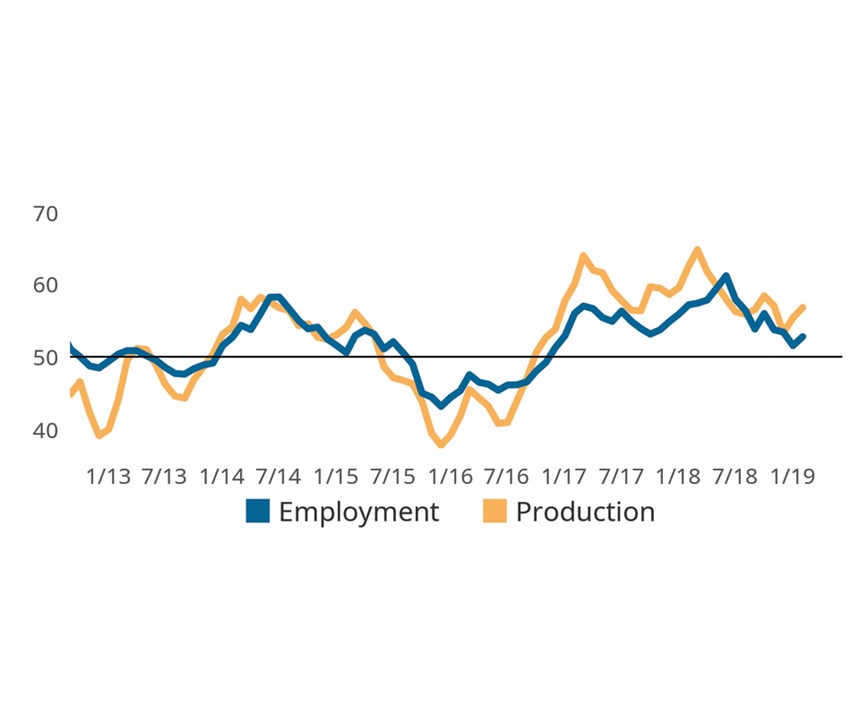

Index Expansion is Slightly Below Average Expansionary Rate

February expansion rate is just shy of average 2017-2018 business cycle expansion rate.

Registering 54.4 for February, the Gardner Business Index (GBI): Precision Machining marked its 28th consecutive month of industry expansion. The current run of expansionary readings marks the longest expansionary phase of all past business cycles recorded by Gardner’s Precision Machining Index. While aged by historical standards, the latest reading is less than two points below the average expansionary reading since late 2016. Gardner Intelligence’s review of the underlying components of the Index revealed growth was driven by production, supplier deliveries, new orders and employment. The Index—a calculated average of the components—was pulled lower by backlogs and exports. All components except exports expanded during the month.

That five of the six business measures used in calculating the Index registered above 50 (indicating expansion) with only exports contracting in February points to the ongoing strength of domestic demand for U.S. manufactured goods. The slowing growth in supplier deliveries—which experienced explosive growth in mid-2018 on a surge in early 2018 new orders—combined with growth in both total new orders and production in late 2018 and early 2019 suggest that domestic demand for manufactured goods continues to more than offset weak foreign demand. The strength of February’s employment data, which is often correlated with an industry’s long-run outlook for the future, suggest that precision manufacturers continue to have high expectations for 2019.

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)