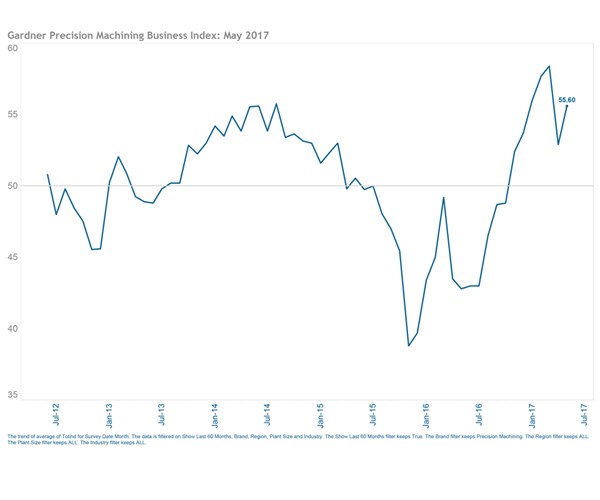

Gardner Business Index: Precision Machining, May 2017 - 55.6

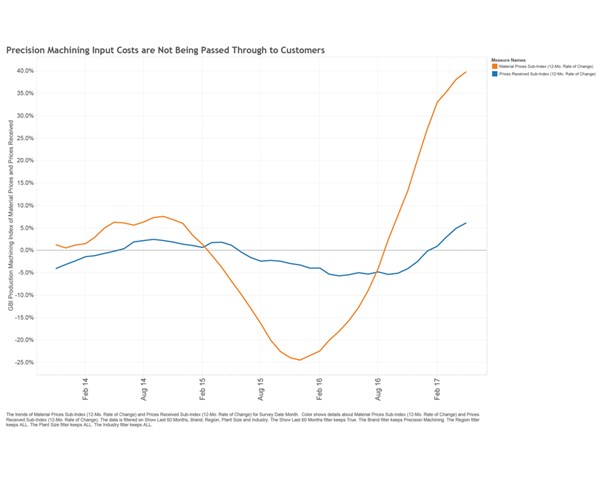

Given the large delta between prices received and input costs, it may only be a matter of time before rising input costs are passed along to machine consumers.

The May index value of 55.6 was a reversal from the six-point move that occurred between March and April. In the first five months of 2017, the Gardner Business Index for Production Machining has done very well, averaging more than 56, suggesting that the industry is doing well. Index components supporting the positive view of the industry include the Production and New Orders components. The Production and New Orders index values average over the last three months have exceeded values of 62 and 59, respectively.

Within the GBI Production Machining Index, material prices continue to present a challenge to the industry. The three-month averaged index value for material prices is up 35 percent from the same three-month period a year ago. Furthermore, our index data comparing prices received with input costs shows a wider gap than at any time reported in the last five years. Given the large delta between these indices, it may only be a matter of time before rising input costs are passed along to machine consumers in the form of higher machine costs.

While PM production and order numbers are have done well in 2017, the export component continues to trend sideways. The trend that GBI is seeing in the PM export data, however, is not unique to PM, this trend has been observed in other GBI Indices as well. GBI will be watching currency markets closely in 2017 for a multitude of reasons, including the progression of Brexit, America’s changing stance on free-trade and trade agreements and the government’s involvement to make markets fairer for American companies. All these political factors could generate unexpected shocks to currencies and thus import and export dynamics and volumes.

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)