PMI Benefits from Expanding Production Activity

Volatile shifts in Index components may be a sign of more to come.

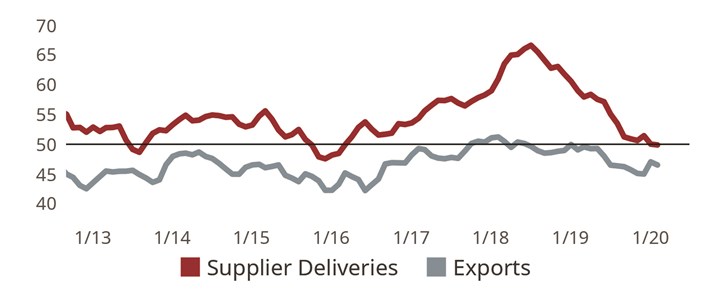

February’s strong expansion in supplier delivery activity was more than offset by a quickening contraction in export activity and an enduring contraction in backlogs. The overall result was an eighth month of contracting total business activity.

The Precision Machining Index increased slightly in February to 48.6 as most components reported higher figures as compared with the prior month. Gardner Intelligence’s review of the underlying index observed that the Index — calculated as an average of its components — was supported by an eight-month high in production activity and a modest expansion in employment. The Index was pulled lower by a sharp contraction in export activity and a ninth consecutive month of contracting backlog activity.

Manufacturing Outlook as a Result of COVID-19: The impact of COVID-19, widely known as the “Coronavirus,” is expected to have an adverse effect on the Precision Machining Index in the coming months. The efforts of Asian governments in January and February — and by a widening collection of nations in February and March — to combat the spread of COVID-19 while necessary, is also having a detrimental impact on the world’s supply chain, as workers, companies and cities are affected by quarantine measures. This will most immediately restrict the normal flow of upstream and sub-component goods that are necessary for the proper functioning of the manufacturing sector.

The Precision Machining Index is unique in its ability to measure business conditions specific to the industry on a monthly basis. This means that moving forward, the Index will be able to quantify both the negative impact from the virus at present along with the timing and strength of the industry’s eventual recovery from this virus.

Gardner Intelligence expects that most (if not all) of its indicators will be subjected to shocks from COVID-19. The fact that the virus originated in Asia suggests that American manufacturers in the immediate future should pay particular attention to their supply chains and expect increased volatility in export orders and material prices.

At this time, it is particularly important for our readers to complete the GBI survey sent to them each month. Your participation will enable the best and most accurate reporting of the true magnitude and duration of COVID-19. It will allow you and your peers to make data-driven decisions at a time when there may be a strong temptation to make impulsive gut decisions that could make a difficult situation worse.

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)