Production Machining Activity Contraction Slows at Year End

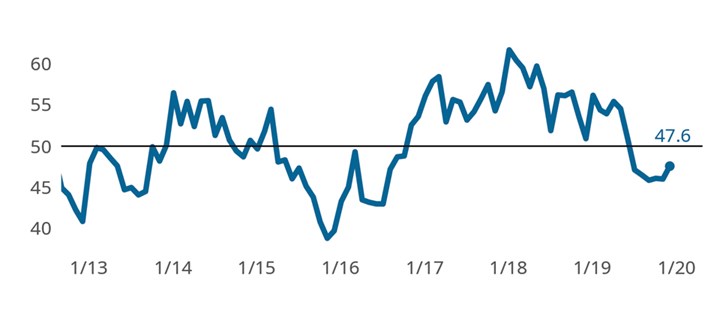

The Precision Machining Index moved higher in the last month of 2019, registering 47.6. December’s relatively higher reading compared with the prior month’s indicates that business activity contracted at a slower rate in the latest month.

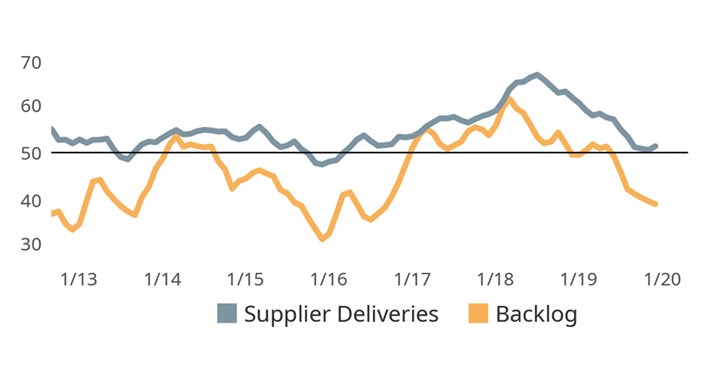

The Precision Machining Index moved higher in the last month of 2019, registering 47.6. December’s relatively higher reading compared with the prior month’s indicates that business activity contracted at a slower rate in the latest month. Readings above 50 indicate expanding activity and values below 50 indicate contracting activity. The further away a reading is from 50 the bigger the change in activity. Gardner Intelligence’s analysis of the underlying index components found that the Index was supported by expanding activity in new orders and supplier deliveries along with an improved -but still contracting- reading for production. The Index—an average of its components—was pulled lower by contractionary readings for employment, exports and backlogs. December’s strongly contracting backlog reading weighed down the Index significantly more than any other component.

The closing quarter of 2019 experienced components rebounding off their lows from the third quarter. Production, employment, supplier deliveries and new orders all reported their fastest pace of contracting activity around the July to October period. Only export and backlog activity at year-end continued to face a strengthening contraction. December’s first expansion of total new orders since June, coupled with a relatively strong contraction in export activity implied a rebound in domestic manufacturing orders. December’s implied domestic orders’ rebound, combined with almost unchanged levels of production activity, is believed to have slowed the contraction in backlogs.

Precision Machining Index: The Precision Machining Index ended the year indicating that the industry was still contracting, but at its slowest rate in six months. December experienced an expansion in business activity as new orders and supplier deliveries both registered readings above 50.

About the Author

Michael Guckes

Michael Guckes is chief economist at Gardner Intelligence, the research and market intelligence division of Gardner Business Media. He provides forecasting, modeling and consulting services to clients and provides content for all Gardner brands. For more information about Gardner’s Business Index, visit gardnerintelligence.com.

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)