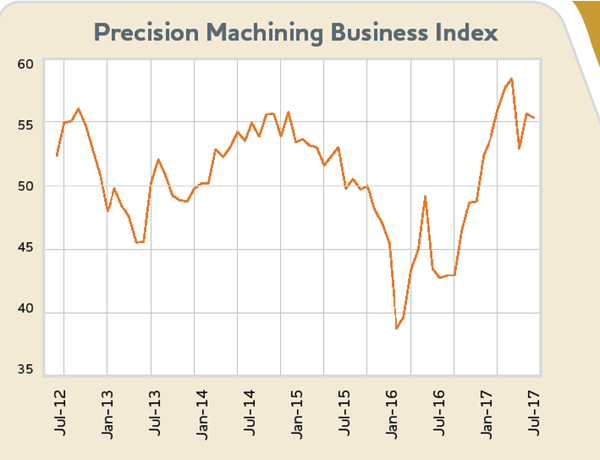

Production Machining Index: June 2017 - 55.3

Production Machining Business Index is holding steady.

The June index value of 55.3 was almost unchanged from one month ago with strength in Production and new orders being offset by exports and backlogs. June’s total index value was only slightly below the average for the first half of 2017 (56.0). Compared with the first half of 2016 (44.5), the index indicates a significant turnaround has occurred in the production machining industry over the last 18 months from that of modest contraction to stable growth.

The drivers behind the Production Machining Index’s expansion during the first half of 2017 have included production, new orders and supplier deliveries. Production has been particularly strong through the first half of 2017, recording a six-month average of 61.7. In no other six-month period has Production performed this strongly in at least the last five years. The turnaround in production over the last 18 months has been by all accounts highly impressive. During the first half of 2016, the production index averaged 43.3, the lowest six-month average since at least 2012.

Conversely, the exports and backlogs components of the Production index are and continue to be the weak elements in the index. The June exports result (48.1) marked the 21st consecutive month of weakness in production machining export. When an index component falls below 50 it indicates that more businesses are experiencing contraction in that aspect of their business while a value of 50 indicates no change and values above 50 indicate expansion or growth. The export index over the last five years has closely tracked with the U.S. dollar index in an inverted relationship. When the value of the dollar strengthens/weakens, the export index tends to decline/improve soon after. The modest decline in the value of the dollar against major currencies in the first half of 2017 may explain in part why Gardner’s exports reading has been unimpressive in the year-to-date period. Should the Federal Reserve decide on more interest rate increases in 2017, this could result in a stronger dollar, placing downward pressure on future exports readings.

Resembling the turnaround experienced by Gardner’s production readings since 2016, Backlogs have also staged an impressive comeback after hitting a low of 35.2 in 2016 before staging a sharp reversal, culminating in a multi-year high of 55.9 in February 2017. Since then, backlogs have mostly held their gains with a June reading of 51.7.

Job shops within the production machining industry faced high pressure, according to June’s survey results, as both exports (47.0) and backlogs (48.9) reported contractions for a second month in a row. Compared with the total production machining index, job shops for the month experienced a significantly smaller boost from supplier deliveries, which fell almost six points from May to June, ending the month at 53.9.

For more information about the June GBI as well as past GBIs, visit gardnerweb.com/economics/blog.

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)