Unique 2020 Recession Impacts Market Segments Differently

There are many reasons why the present recession requires business leaders to think differently about this recession and not necessarily rely on the lessons learned from past downturns.

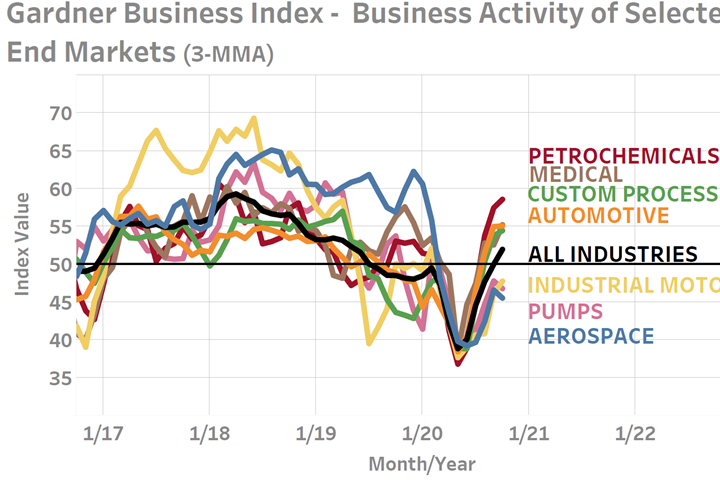

Unlike recessions of the past that were caused by rising inflation, failed deregulation, shocks to investment spending and/or asset bubbles, the 2020 recession is not financially induced, but instead is pandemic induced. Given the unique nature of each recession, it would be detrimental for manufacturing leaders to simply plan for 2021 based on the lessons learned from past recessions. By leveraging information about what has been learned about the economy in the first six months of the pandemic, manufacturers can best plan and position their firms for 2021. The variation in business activity by end market as learned by manufacturers responding to the Gardner Business Index (GBI) manifest that this recession is anything but uniform in its treatment of individual markets.

While entertainment, hotels and transportation — along with their employees — have been some of the most affected, other industries have found ways to mitigate, sidestep or even benefit from COVID-19. Ensuring changes in what and how goods and services are now being consumed resulted in rising demand for certain goods, including homes, RVs, home improvement products and groceries, among others. This exemplifies the first and most important aspect of this pandemic recession: This recession is uniquely segregating the economy into those industries that can find ways to function during COVID-19 and those that cannot. For manufacturers, this means that surviving or even thriving in 2021 may depend on the ability to market to those end markets that have been sidestepped by COVID-19 or are even thriving.

The Gardner Business Index shows business activity in 2020 has been highly variable by end market as rules and regulations designed to slow the spread of COVID-19 have had variegated results by industry. Values above 50 represent expanding business activity and values below 50 representing contracting business activity. A reading of exactly 50 represents no change in activity. The farther away from 50 the Index reading is, the more widespread is the industry’s expansion/contraction being reported.

Despite the economic repercussions of policies focused on saving lives and mitigating the spread of COVID-19, there has also been a lot of government intervention conducted quickly to prevent a far worse economic outcome. During only the first three quarters of 2020, the U.S. Treasury spent $2.38 trillion to offset the economic damage of COVID-19. This is more than the $1.8 trillion stimulus spent over a four-year period to abate the Great Recession. In addition, the Federal Reserve supported spending by lowering the fed funds rate to near zero in only a two-month period. This starkly contrasts with the 12 months it took the Fed to make a similar move in 2008. The results have been a resilient bond market and an increase in disposable income thanks to stimulus checks, additional unemployment benefits and the government’s direct lending of funds to small businesses through the Paycheck Protection Program. Never has the availability of credit been so available during a recession. It is for these reasons that the financial market has never been better positioned during a pandemic to support both credit markets and asset prices, both of which will encourage spending and mitigate some portion of this recession’s severity.

Automotive Market

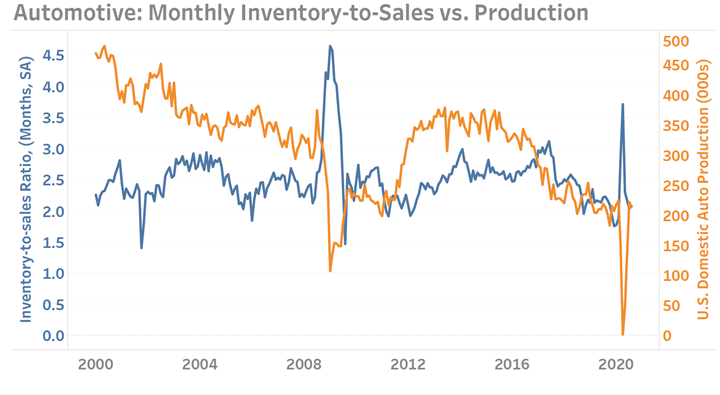

The automotive industry provides a unique window into how government interaction and credit markets have put the industry in a far better position than many might expect. Strong asset prices and the relatively better financial position of middle- and upper-income families has resulted in a stronger automotive industry than expected. Sales in 2020 have been led by luxury vehicle and light truck sales. The hard closure of much of the economy in March and April cut sales volumes, but also shuttered production. The combination of these influences has resulted in strong pricing power at the dealership and lower than average inventories. In contrast, the Great Recession experienced bloated inventories on dealer lots for 12 months while 2020 inventories are at multiyear lows, especially for current year models, which have only a few days or weeks of inventory on lots.

The Great Recession saw bloated inventories on automotive dealers’ lots for 12-months which depressed pricing and profitability despite deep cuts in production. The present pandemic recession has been significantly different as government action halted both sales and production, leading to a snapback in both production and balanced inventory levels.

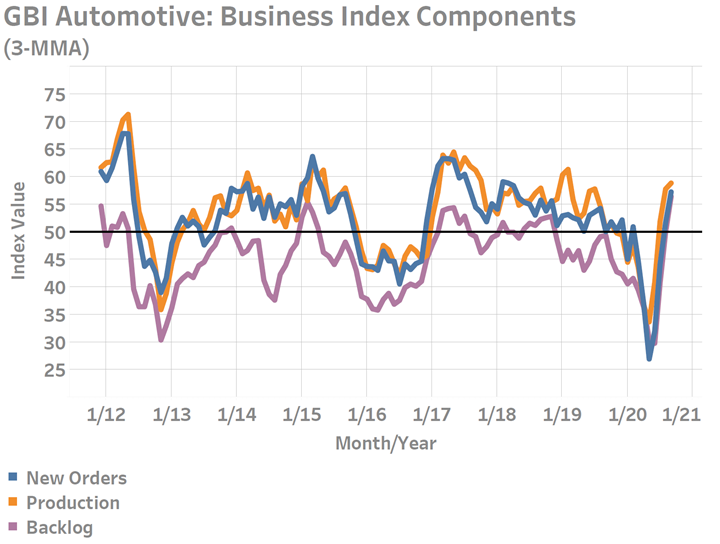

GBI data provided by automotive sector manufacturers supports our optimistic outlook. Beginning in July, a growing proportion of these manufacturers indicated improving new orders, production and backlog activity. Our data illustrates both the unprecedented brevity and extreme volatility of the industry in 2020, further enforcing the unique nature of the current recession.

The severe slowdown in new orders in the first half of 2020 reversed course during the third quarter as month-over-month new orders activity began expanding and taking production with it. Expanding backlogs in Gardner’s data is consistent with the industry’s low inventory-to-sales situation.

Aerospace Market

Passenger air travel has been one of the most severely affected markets in 2020. Despite this, aerospace manufacturing is being supported by several silver linings. The first of these is access to the credit markets. Despite a 96% decline in U.S. air passenger screening at U.S. airports in April in a few short weeks, Boeing simultaneously turned down a $17 billion government aid offer and instead raised $25 billion dollars from a commercial bond sale. This provided Boeing with a massive cash infusion, which stood at over $22 billion at the end of the second quarter and will give the company many quarters in which to bring the 737 Max back to the market and continue other strategic initiatives. All of this will help to maintain its massive supply chain and upstream partners well into 2021.

The second silver lining can be seen in the surging demand for air freight services that has resulted in high double- and triple-digit rate increases at a time when passenger aircraft are being underutilized. This has been a lifeline for airlines that have found innovative ways to capitalize on this shift by removing seats to make way for pallets and by filling otherwise empty overhead bin with freight contents. While the overall production balance between passenger and freighters shifted in 2020, it has given manufacturers and airlines some breathing space.

Finally, demand for air travel is likely to return at scale once there is a vaccine available or other way to mitigate the risks of COVID-19. A study by Gardner Intelligence in late 2020 found that 43% of respondents surveyed would consume at least 75% of the air travel they did pre-pandemic once the risk to COVID-19 has been neutralized. Furthermore, over 62% indicated they would consume 50% or more. In China, where air travel restrictions have been largely lifted, demand has already made a strong comeback. After declining by 83% between December and February, passenger revenue miles rebounded strongly in the six months following, slicing the decline by half. Passenger air travel consumption at the end of August was down only 39% from its December level. Should the U.S. market exhibit anything close to such a rebound it would easily exceed industry forecasts calling for multiple years of slowly rebounding passenger volumes. If this recession should continue to have a more modest impact on middle- and upper-income travelers, airline profitability may return faster as first- and business-class seat sales rebound.

There are many reasons why the present recession requires business leaders to think differently about this recession and not necessarily rely on the lessons learned from past downturns. Importantly, those opportunities that exist may contrast with the traditional mindset of looking for opportunity in consumer-defensive markets, as many consumers are bucking past recession behavior by buying high-ticket items at a time when wealth creation continues to expand rather than collapse.

About the Author

Michael Guckes

Michael Guckes is chief economist at Gardner Intelligence, the research and market intelligence division of Gardner Business Media. He provides forecasting, modeling and consulting services to clients and provides content for all Gardner brands. For more information about Gardner’s Business Index, visit gardnerintelligence.com.

Related Content

The Value of Mass Finishing, Shot Blasting for Aerospace and Medical Applications

The choice between mass finishing and shot blasting for CNC-machined parts depends on the specific requirements of the application.

Read MoreJR Machine Launches Expansion Strategy, Hires New CEO

An investment from Schneider Resources Holding positions JR Machine to grow in emerging markets such space exploration and green energy.

Read MoreForkardt Hardinge Swiss Workholding Provides Reliable, Consistent Performance

The company’s Swiss collets are designed to securely hold parts without marring surfaces, minimizing vibration to ensure smoother machining, enhanced accuracy and extended tool life.

Read MoreT.J. Davies Retention Knobs Harden Over Time

Each retention knob is magnetic particle tested and pull tested to 2.5X the pulling force of the drawbar it is designed for.

Read MoreRead Next

Index Contracts in September After a Promising August

All components report lower readings after August expansion.

Read MoreEmerging Leaders Nominations Now Open

Here’s your chance to highlight a young person in your manufacturing business who is on the path to be a future leader moving your company forward.

Read More5 Aspects of PMTS I Appreciate

The three-day edition of the 2025 Precision Machining Technology Show kicks off at the start of April. I’ll be there, and here are some reasons why.

Read More

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)