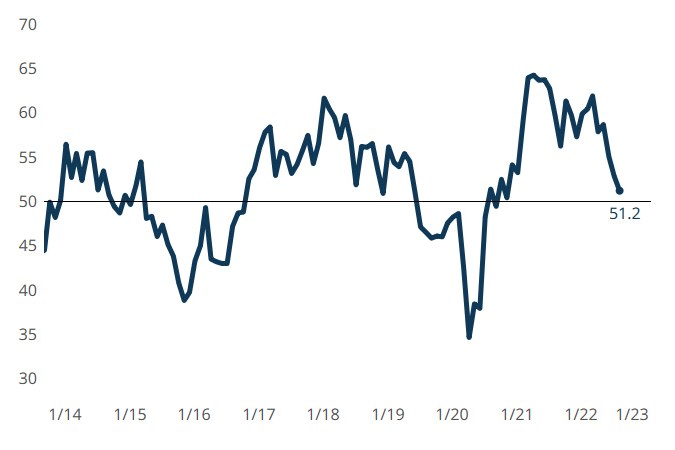

Gardner Business Index: Precision Machining August 2022

Precision Machining saw another slowing of GBI growth in August, the magnitude of deceleration smaller than July’s, which was smaller than June’s.

The Gardner Business Intelligence (GBI) Precision Machining Index closed August at 51.2, compared to July’s 52.9, a smaller drop than each of the 2 months prior, suggesting a slowdown in the rate at which growth is slowing. (See last month’s reading.)

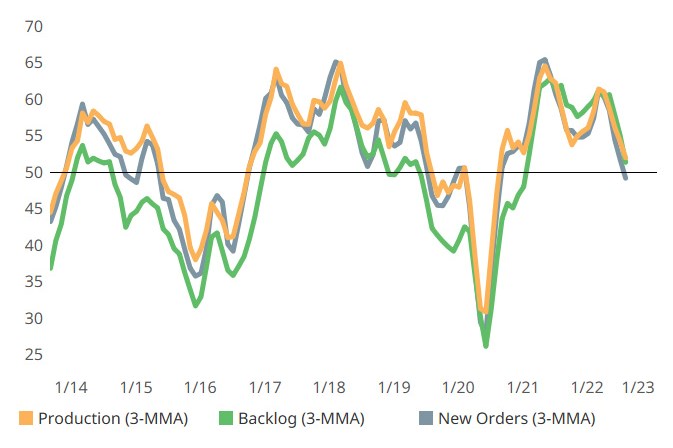

GBI: Precision Machining component activity in August is the same as it has been for the past 3-5 months, depending on the component.

- Every GBI component, with the exceptions of new orders and exports, decelerated growth in August.

- New orders actually started contracting in August, landing at a level that is 16 points lower than the last peak in May 2021.

- Exports continued to contract at an accelerating rate in August.

Precision Machining Business Index

Precision Machining showed slowing growth again in August, moving in the same direction for the third month straight.

Key Components (3-month moving averages)

GBI components, backlog and production moved in parallel to ‘close cousin,’ new orders, but managed to stay in growth mode in August. Employment growth decelerated again, ending the month at about the same reading as the other two components that stayed ‘above the line’ in August.

.png;maxWidth=300;quality=90)