Precision Machining Index Up on the Return of Employees

Hiring activity lifts overall index.

The Gardner Business Intelligence (GBI) Precision Machining Index rose 5 points during October to end at 61.3. (See last month’s reading.) Four of the Index’s six components registered quickening expansion during the month, led by employment with an 11-point gain and closely followed by smaller expansionary readings for new orders and production. Supplier deliveries activity reported its sixth consecutive month above a reading of 80. Both the duration and amplitude of such readings is unprecedented in the history of the index and confirms that supply chain challenges have been — and will remain — the most significant problems for the industry in 2022.

Precision Machining Index: The Precision Machining Index signaled increasing expansion in business activity in October, driven largely by elevated employment and supplier delivery activity readings.

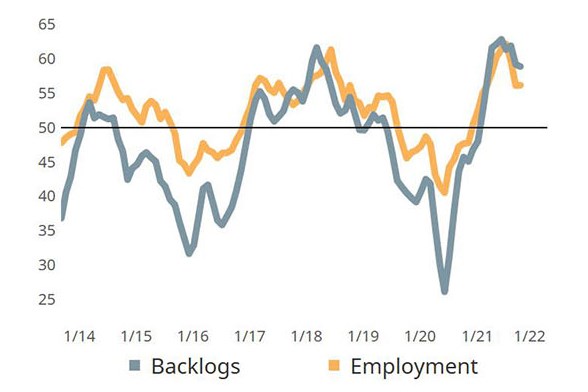

Among all manufacturing disciplines, production machinists have reported the narrowest production gap among all manufacturing disciplines tracked by GBI. This gap — measured as the difference between new orders and production readings — widened during the two preceding months before closing almost completely in October. The narrowness of this gap may in part explain why backlog activity since 2Q2021 has registered less aggressive levels of expansion relative to many other manufacturing disciplines.

Employment Increase a Good Omen: For the fourth time in YTD-2021, employment activity registered above 60, implying strong payroll growth among production machinists. Increasing payrolls should pay dividends to production levels and eventually reduce the year’s accumulated backlogs.

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)