Disrupted supply chains, which were for a short while the wind in the sails of American manufacturers, are now becoming an anchor that slows American manufacturing down.

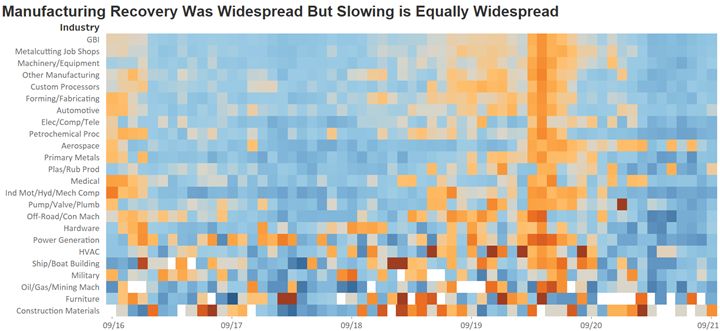

As the economy was locked down in April 2020, the service economy came to a grinding halt. Manufacturing was briefly affected by the lockdown, but in a few months manufacturing was one of the, if not the only, bright spots of the economy. The Gardner Business Index (GBI) showed that by the summer of 2020 many manufacturing sectors were growing once again. By the fall, the majority of manufacturing was roaring back to life. And, by the spring of 2021, every single manufacturing market tracked by the GBI was growing at a significant rate.

A major reason for the surge in U.S. manufacturing was disrupted international supply chains that caused U.S. OEMs to reorient their supply chains to more domestic manufacturing. Yet, these disrupted supply chains, which were for a short while the wind in the sails of American manufacturers, are now becoming an anchor that slows American manufacturing down. Since the late summer of 2021, almost every manufacturing sector tracked by GBI displayed slowing growth.

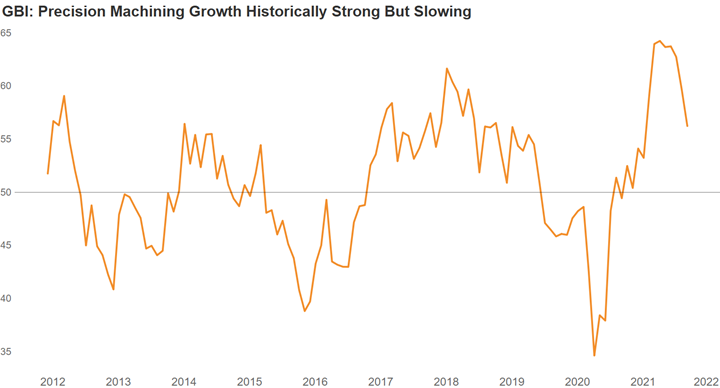

And, due to the nature of the calculation of the GBI, the growth was only as strong as it was because supply chains remained extended. The GBI: Precision Machining provides an excellent example of what has happened. When manufacturing is growing, it is expected that supply chains will lengthen as all manufacturers need to catch up with the dramatic increase in orders. Normally, the supplier deliveries index will peak at a similar level but only after the other components of the GBI peak. This is exactly what happened in the expansion during 2017 and 2018.

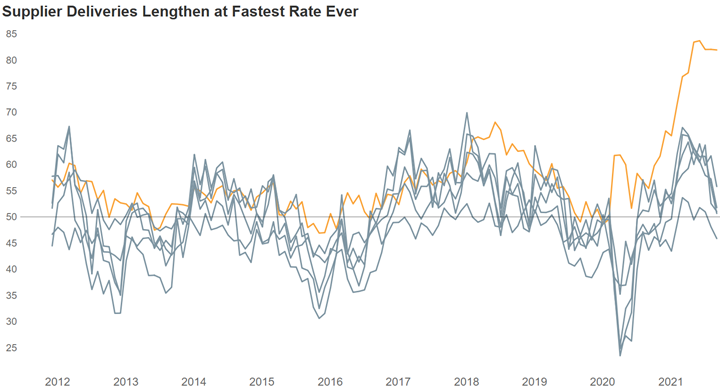

In the current expansion, the lengthening of supplier deliveries exceeded anything manufacturing has ever seen. Supplier deliveries are the orange line in the third chart below (Supplier Deliveries Lengthen at Fastest Rate Ever). Notice that instead of contracting with all of the other sub-indices in 2020, the supplier delivery index increased, indicating a lengthening of the supply chain despite overall precision machining activity declining. This was a problem, but an understandable one because of the lockdowns.

Each square represents one month. Blue squares are growth. Orange squares are contraction. The darker the color, the faster the growth or contraction. In March and April 2021, every industry tracked by the GBI was growing faster (blue squares getting darker). For almost every industry, accelerating growth continued until June 2021. Since that time, almost every industry was growing slower (blue squares getting lighter).

As the precision machining industry recovered, supply chains never had a chance to catch. Therefore, the supplier deliveries index rose even higher, indicating that supply chains were becoming more and more stretched. By June 2021, the supplier deliveries index reached an all-time high of 83.8, and it has remained close to that level. At the same time, every other GBI component has declined significantly.

So, the supply chain disruption that once helped manufacturing is not hurting manufacturing. Manufacturers, including precision machine shops, struggle to get the materials, components and supplies they need to make their products. When these components can be procured, they are costing significantly more. While inflation is often said to always be a monetary problem, the current supply chain disruptions from shutting down the global economy are leading to rapidly rising prices in numerous commodities.

An interesting piece by Nick Colas of DataTrek Research showed how the phrase “supply chain disruption” has become a type of shorthand to link together and explain product shortages and inflation. His most interesting point, though, was that the current supply chain disruption reminded him of

In September, the GBI: Precision Machining was 56.3. While the rate of growth was historically strong, it has slowed noticeably since its peak in April 2021. Also, the current level of growth is somewhat misleading as the components of the index are moving out of sync with one another.

the 1973 oil shock. He stated that the oil embargo caused U.S. inflation to rise so rapidly because the economy was structurally set up for low energy prices. We have a similar problem now because the economy is structurally set up for globally distributed supply chains with just-in-time deliveries made possible by lean manufacturing. And, now that that structure has been disrupted, prices are rising rapidly. Ultimately, it could take a significant rise in interest rates and another recession to put an end to the current inflation and supply chain disruption as it did in the late 1970s and early 1980s.

There isn’t an industry that is not affected by these twin factors of supply chain disruption and inflation. But, there is another factor that is likely to affect manufacturing in 2022, which is the labor shortage. Manufacturing has dealt with the lack of skilled labor for at least a decade, if not longer. While it is not ideal, manufacturers have been able to cope with this lack of labor through increased automation, and will likely continue with the labor shortage in the same way.

However, what happens when the end markets important to many precision machine shops suffer their own labor shortages? Will they still demand the same number of parts from precision machine shops?

The orange line represents supplier deliveries while the gray lines are all the other components of the GBI:PM. Supply chain disruption continues to cause major problems in the precision machining industry as supplier deliveries (82.0 in September) are lengthening at virtually the fastest rate in the history of the GBI: Precision Machining. The extreme supply chain disruption is artificially inflating the growth in the industry as every other subindex is growing significantly slower or contracting since the spring of 2021.

For example, the health care industry was already struggling with a shortage of nurses. Now, because of vaccine mandates, a seemingly small but significant percentage of nurses (and other health care providers) could be losing their jobs. Fewer health care providers could hinder the “production” of health care. Health care providers are not easily replaced with automation. So, this could result in decreased demand for the types of parts precision machine shops manufacture for the medical industry.

Or, consider the air travel and aerospace industry. In October, Southwest Airlines was forced to cancel thousands of flights. Initially, the company claimed the cancellations were due to weather. Others speculated that the pilots and other crew members didn’t show for work as part of a “sick-out” as they used up their time off before being fired for refusing COVID-19 vaccines. Pilots are not easily replaced and cannot be automated. It would not take many pilots on a sick-out or fired from their jobs before there would be a significant reduction in the number of planes and parts needed for the aerospace industry.

By nature, manufacturers are resourceful and have the ability to solve many problems. However, many of the problems manufacturers are being faced with at the moment are seemingly self-inflicted. If the self-inflicted problems of supply chain disruption (economic lockdowns), rising inflation (massive amount of new money created because of the lockdowns) and labor shortages (likely exacerbated by vaccine mandates) were resolved, manufacturing would likely boom to restore depleted inventories. However, if these self-inflicted problems are left to fester, then manufacturing may face a significant recession.

About the Author

Steve Kline, Jr.

Steve Kline is the former chief data officer at Gardner Business Media Inc. and has produced forecasts for his family’s business and the metalworking and plastics industries. Mr. Kline has been working on Gardner’s Capital Spending Survey, the Gardner Business Index, and Top Shops benchmarking survey from 2008 to 2021. He graduated from Vanderbilt University with a degree in civil engineering and has an MBA with an emphasis in finance from the University of Cincinnati.

Related Content

Gift a 3D Printer to an Employee?

Some shops have purchased inexpensive polymer 3D printers for their operations. Does it make sense to take this a step further and give (or loan) a sharp young employee one to experiment with at home? This small investment could pay off for your shop in different ways.

Read MoreSuccession Planning: Three 15-Minute Activities to Start Preparing for Tomorrow

Succession planning is planning for the future success of your business.

Read More2023 Emerging Leaders Strengthen Their Staffs, Solve Problems

Superb critical thinking, top-notch leadership skills and a passion for building a strong team are a few of the common traits held by this year’s five Production Machining Emerging Leader award winners.

Read MoreVideo Tech Brief: CNC Screw Machines a Solution for Overcoming Labor Shortages

CNC screw machines can exceed job shop productivity and enable manufacturers to overcome perpetual employment gaps.

Read MoreRead Next

Production Machining Activity Slowed in Third Quarter

Third quarter activity was complicated by hiring and supply chain constraints

Read More5 Aspects of PMTS I Appreciate

The three-day edition of the 2025 Precision Machining Technology Show kicks off at the start of April. I’ll be there, and here are some reasons why.

Read MoreDo You Have Single Points of Failure?

Plans need to be in place before a catastrophic event occurs.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)