Precision Index Contracts as Coronavirus Disrupts

Multiple Index Components Report Record Lows

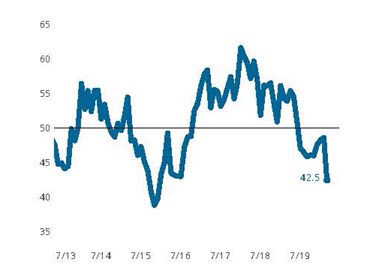

Precision Machining Index: The production machining industry was hard hit in March by the forced closure of much of the world’s economy in order to slow the spread of COVID-19. In the previous months, the Index had been indicating a near-term rebound for the industry thanks to improving new orders and production activity.

The March data for the Precision Machining Index (PMI) reported a six-point contraction to end at 42.5. Gardner Intelligence’s review of the underlying Index components observed that the Index, calculated as an average of its components, saw several components reach lows last set in late 2015.

Supplier Deliveries Lengthen While New Orders Fall To All-Time Low: Survey respondents reported a steep contraction among most elements of business activity. The reading for supplier deliveries is designed to increase when supplier deliveries slow under the assumption that suppliers are experiencing higher backlogs and need longer to get parts to manufacturers. In the current situation, it is COVID-19’s disruption to the world’s supply chains that is causing longer delivery times.

These readings represent the breadth of change occurring within the production machining industry and are not to be confused with the rate of decline taking place. These low readings indicate that a large number of manufacturers reported a decreased level of business activity without quantifying the actual magnitude of the downward change.

Dissimilar to the other components of the PMI, the reading for supplier deliveries moved significantly higher. In normal times when demand for upstream goods is high, supply chains cannot keep pace with these orders. The resulting backlog of supplier orders thus lengthens their delivery times. This delay causes our surveyed firms to report slowing deliveries, and by our survey’s design, elevates the supplier deliveries reading.

The world’s efforts to slow the spread of COVID-19 has disrupted supply chains worldwide. It is this disruption, as opposed to strong demand for upstream products overall, that supplier delivery times have lengthened, and the reading has increased.

.jpg;width=70;height=70;mode=crop)