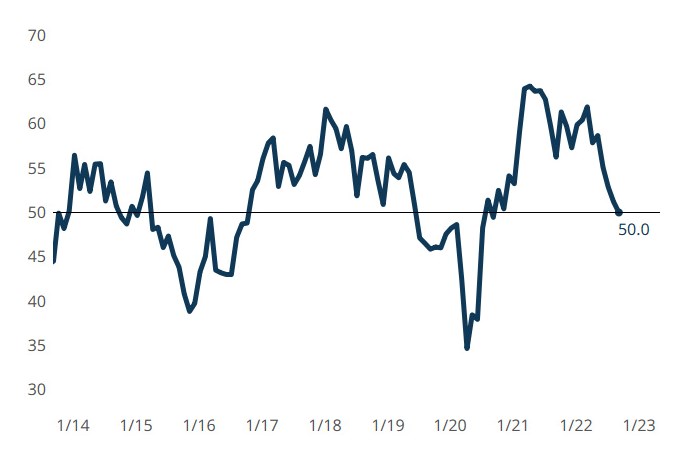

Gardner Business Index: Precision Machining September 2022

In September, Precision Machining ended an almost 2-year growth trend with a flat index of 50.

The Gardner Business Intelligence (GBI) Precision Machining Index hit 50 in September, ending an almost 2-year growth trend. An index of 50 signals ‘flat,’ meaning the average of the six GBI components is basically a wash — with components on the upswing offset by components on the downswing. (See last month’s reading.)

GBI: Precision Machining activity shows 4 of 6 components flat or contracting:

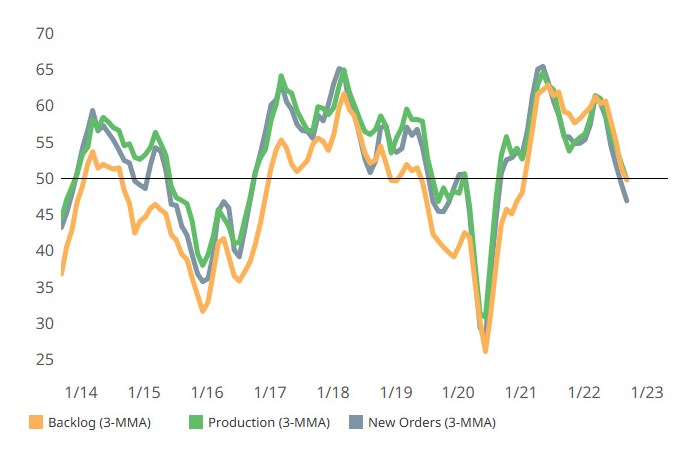

- The decelerating growth seen in production and backlog the past few months ended up flat in September. That means neither growth nor contraction was evident.

- New orders contracted at a faster rate, while exports contracted at about the same rate as August.

- New orders and production are both down more than 2 points versus August.

- Supplier deliveries continue to lengthen at a slower rate. The trend likely reflects easing of supply chain pains because other GBI components do not suggest lengthened deliveries are due to strong demand/volume.

- Employment is the only component that grew at about the same rate in September that it did in August.

Precision Machining Business Index

Precision Machining’s slowing growth trend over the past few months landed at a flat reading of 50 in September.

Key Components (3-month moving average)

GBI components, backlog and production, ended with readings of ‘no change’ in September. New orders contracted at a quickening pace

.png;maxWidth=300;quality=90)