Firm Grip on the Future

This Indiana workholding manufacturer has been in business for 97 years. Its recent and ongoing investment in plant and capital equipment ensures its place as a leading supplier of standard and specialty workholding solutions for the turned parts industry.

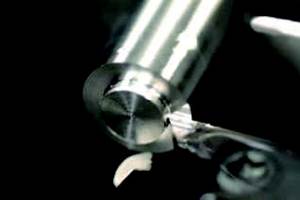

Logansport Machine Company (LMC) has occupied the same piece of ground since its 1916 founding in Logansport, Ind. Today, it is a global manufacturer of standard and custom workholding products and services including chucks, actuators, face drivers, centers and steady rests, with manufacturing facilities and joint ventures in the U.S., Europe and Asia. Its workholding products range in capacity from 2.5 inches to more than 7.0 meters.

My visit to the plant was prompted by a press release informing PM that the company has just completed a multi-million dollar expansion at its Logansport facility, including new machine tools, green lighting, office renovations and other plant improvements. Curious to find out more, I arranged to meet with company president and third generation owner, Jay Duerr.

“The upgrading in machine capabilities and plant modernization is driven by the need to serve a customer base that is ever changing in its requirements for sophisticated and high performance workholding that is able to increase productivity and lower production costs,” says Mr. Duerr. “Regardless of the part diameter, the metalworking industry is being driven forward in these directions. We must be able to keep pace with the changing nature of workholding, which in addition to bar-fed raw stock, includes more forging applications, near net shape, backworking on sub-spindles and multitasking machining as well as automation for quick change-over.”

Evolution

When LMC opened, its primary business was valves, hydraulic presses and stationary cylinders. “Actually, workholding was a very small part of the business early on,” Mr. Duerr says. “It evolved primarily to support the company’s other manufacturing activities.”

In 1970 Mr. Duerr’s grandfather bought the business from the founding family, but was unfortunately killed shortly after in a plane crash. That brought Mr. Duerr’s father into the business and things began to change.

“After an interim to learn the business, my father took over the company,” Mr. Duerr recalls. “At that time, we had three businesses: presses, valves and workholding. Dad sold the press and valve businesses to concentrate on workholding. He saw that market as more sustainable.”

That move left the company in a strong financial position to weather the recession of the early 1980s when much of the domestic machine tool industry, which was LMC’s primary customer base, “went over the cliff.”

“Of course, machine tools didn’t go away,” Mr. Duerr says. “Their country of origin simply changed, and we responded to that.”

In the early 1980s LMC partnered as a domestic supplier to Matsamoto machine to provide workholding for the Japanese machine tool brands coming into the market at that time. “Around that time, we acquired Buck Chuck Company, based out of Kalamazoo, Mich., and formed Buck Logansport,” Mr. Duerr says. “We used the brand recognition of Buck as the lead name for all of our workholding products.”

In 1996, LMC decided the manual chuck and manual chuck business was becoming very commoditized and competition was fierce. LMC sold the Buck name and the manual chuck division and concentrated on its Logansport Matsamoto division to manufacture hydraulic actuators and international-style standard and special power chucks and cylinders.

“With that realignment,” Mr. Duerr says, “we set up commodity chuck manufacturing in Japan and then eventually Taiwan and kept the hydraulic actuator and custom workholding manufacturing here in Logansport. We went back to the roots of the company my grandfather acquired.”

Mr. Duerr says workholding companies tend to be smaller ventures, with a few exceptions, so around the mid 1990s LMC decided it would concentrate on the core business of hydraulic actuation and custom chucks and form joint ventures with other smaller manufacturers overseas to fill voids in the line with new products. LMC recently set up a joint venture with an Italian company to provide face drivers and a company in Sweden to provide steady rests.

Today, LMC is a major supplier of standard and special chucks, hydraulic actuators, fixturing, face drivers and steady rests for major machine tool builders, including Haas Automation, and has qualified for the DMSQP (DMG/Mori Seiki Qualified Peripherals) program to supply workholding for its turning products.

One of the hardest things for workholding companies historically has been getting the technical information from builders to engineer workholding solutions specifically for their machines. That’s why the industry trend toward qualified suppliers is helpful.

“We sign a non-disclosure agreement and, in effect, become a partner with the machine builder who is then willing to provide us with technical specifications, especially on machine spindles and layout of potential machine interferences,” Mr. Duerr says. “It’s good for them because we do what we’re best at—workholding applications—and it’s good for the customer because any required service is performed by factory qualified technicians. It’s a positive step forward for manufacturing, and I think this trend will continue.”

Workholding Trends

“Probably the biggest trend we see in workholding, specifically our specialty chuck business, is the drive to automation,” Mr. Duerr says. “While there is much buzz in the industry about quick change, we approach job change-over differently.”

The benefits of cost reductions associated with unattended or lightly tended operations are well known. However, the degree of automation is often a determining factor.

“We don’t really make a conventionally defined ‘quick change’ chuck at this facility,” Mr. Duerr says. “For truly unattended, lights-out operations, we engineer a fully automated workholding system that incorporates vision systems, servo control that can automatically change the chuck on the machine, to grip the next part. These chucks can individually adjust each jaw to compensate in pressure and geometry. Workholding automation is our specialty and competitive advantage.”

Chucks for the wheel turning industry have been one of LMC’s most successful product lines. These include automotive, but also extend into aerospace, railroads and transportation in general.

Often these applications can be highly variable from wheel to wheel. “We call this variability chaotic manufacturing,” Mr. Duerr says. “For those customers, we design a system that automatically changes out the face of the chuck, while a common base plate remains attached to the machine spindle. One way to think about it is as sort of a chucking version of an automatic tool changer.”

The clamping mechanism for these chucks uses a pull back gripping system that secures the workpiece periphery in an axial direction. This negates the affects of centrifugal forces, which are often a limitation of rotational speed on more conventional radial gripping chucks.

While pull back chucks are not a new concept, what’s new is combining them with programmable, sensor technology that can control stroke and pressure. Rather than use limit switches, LMC employs tunable contact sensors in its custom chucks.

Its steady rest business is an example of improved workholding engineering, and its success stems from the close machine tool builder/vendor relationship that LMC has established. “The top end of our steady rest products, the grippers and rollers, are built by our JV company in Sweden,” Mr. Duerr says. “We manufacture the machine interface based on the technical specifications provided for each machine. These specs tell us where to locate actuators for clearance and how to best attach to each machine way system. This eliminates interference with doors, turrets tailstocks and so on, so in effect, each steady rest is custom. It’s a good collaboration for all parties.”

If I Wanted it Tomorrow

For all its technical advances, current and ongoing, the specialty workholding business is customer driven. Companies, even 97-year-old ones, must keep driving themselves forward or be left behind.

Mr. Duerr relates a story that seems to be a driver behind the continued improvements LMC makes in its manufacturing capabilities. He says, “I had a customer tell me with regards to service and delivery—if I wanted it tomorrow, I would order it tomorrow. Why don’t you have it for me today. Trying to satisfy “instant gratification” seems to be an increasingly integral part of the manufacturing landscape.”

LMC is committed to an ongoing investment strategy that enables it to keep up with the changing needs of its customers and take advantage of improvements in manufacturing technology. This includes capital investments as well as process and plant improvements.

“As part of our mission statement,” Mr. Duerr says, “we want to keep every piece of equipment to be no older than 7 years, and we hope to make that 5 years. We see enough of a jump in technology over a 5- to 7-year period that the productivity gains that can be realized justify the investment.”

The reason LMC is reinvesting now is market driven. Its business has increased, therefore, some of these investments are capacity driven. At the same time, benefits derived from more efficient and productive technology are lowering manufacturing costs and shortening deliveries.

“The metric is time,” Mr. Duerr says. “Producing the amount of actuators and chucks that we can produce today would have taken four to five times longer 15 years ago. Our ability to rapidly respond to customer demands is not a slogan, it’s our driver. Companies that invest in our specialty workholding products cannot be “down,” which makes our ability to respond critical. We do not have the luxury of saying that one-off order has to wait 6 weeks until a machine is available.”

That creates a balancing act to maintain enough machining capacity to respond to rush jobs and still have a reasonable utilization rate for production. In order to help with this balancing act is the centerpiece of the company’s recent capital investment: a seven-pallet horizontal machining cell.

In addition, over the last year, LMC purchased several vertical machining centers, turning centers and grinders. These machines were installed for additional capacity. Over the last 18 months, LMC purchased eight new machines as replacement for older equipment to meet its goal of having no equipment on the floor more than 7 years.

“We’ve gone from a one-shift operation to three shifts in the last year,” Mr. Duerr says. “By installing new, more efficient lighting throughout the shop, along with the more energy efficient machine tools, my energy costs are the same for three shifts as they were for one. If you look, cost savings are everywhere.”

An unanticipated, but positive benefit of LMC’s dedication to reinvestment has been in employee morale. “We upgraded the facilities here along with the equipment,” Mr. Duerr says. “Our people recognize that we are in this for the long haul, and they tend to feel more secure about their futures, which translates to better workforce stability.”

A Young 97

A willingness to change and invest seems to be a hallmark for manufacturing longevity. “Trying, making mistakes and trying again,” Mr. Duerr says, “has been a pattern for LMC through its long history. The secret is to learn from mistakes and rectify them with new ways that move the business forward. Customers appreciate effort from their suppliers. They will not condone complacency.”

Related Content

Tool Path Improves Chip Management for Swiss-Type Lathes

This simple change to a Swiss-type turning machine’s tool path can dramatically improve its ability to manage chips.

Read MoreWhat Is Trochoidal Turning? How Might Shops Benefit From It?

While trochoidal milling might be a more well-known toolpath strategy, trochoidal turning can offer similar benefits such as high material removal rates especially for rough-turning operations.

Read MoreThe Ins and Outs of Inserts

Understanding how inserts are made provides valuable insight into how their performance can be optimized.

Read MoreBroaching Tool Technology For Lathes Used to Slot Inconel Parts

This shop finds value in using an indexable-insert-style broaching tool to create blind-hole slots in heat-treated Inconel aerospace parts on a CNC lathe.

Read MoreRead Next

The Many Sides of Workholding

Here's a broad look at different ways to approach workholding, from bar feeders to collet chucks to robotics.

Read MoreEmerging Leaders Nominations Now Open

Here’s your chance to highlight a young person in your manufacturing business who is on the path to be a future leader moving your company forward.

Read MoreA Tooling Workshop Worth a Visit

Marubeni Citizen-Cincom’s tooling and accessory workshop offers a chance to learn more about ancillary devices that can boost machining efficiency and capability.

Read More

.png;maxWidth=970;quality=90)