We are all aware of the effects of supply chain disruptions, inflation and labor shortages ushered in and/or exacerbated by COVID-19. Even so, for most of the metalworking industry, business has been pretty good for the last two years. That’s been reflected both in the U.S. consumption of machine tools and in the Gardner Business Index (GBI), which has shown positive growth since the second half of 2020. Will this momentum carry us through 2023?

It all depends on a variety of economic forces in play and how they could impact your specific business. Economists might disagree on whether there will be a recession next year. But, if there is one, most experts concur that it is not likely to be severe. Plus, most industry analysts doubt it will have a major impact on the manufacturing sector, barring extraordinary events.

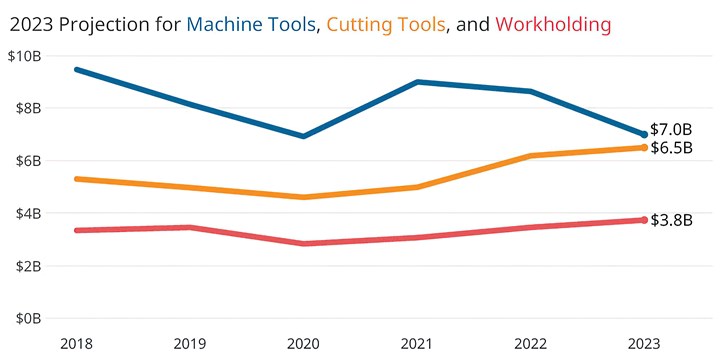

However, business in the metalworking sector is slowing, and we at Gardner Intelligence expect that to continue into next year. According to Gardner Business Media’s Capital Spending Survey, the U.S. market for machine tools will be down some 19% in 2023 (after a very strong market for the last five years) and it will still be at a healthy consumption level of $7 billion. The survey indicates that both the cutting tool and workholding markets will be up next year by 5% and 8%, respectively. Following these markets is important as they help paint a picture of overall metalworking activity beyond capital spending.

It’s important to note, though, that the Capital Spending Survey is not a forecast. Rather, it is a projection of buyer intent based on responses to a survey conducted in July of this year, a time of significant uncertainty. As testimony to the sentiment at that time, a question on the survey that is separate from the GBI asks expectations for investing in equipment during the next 12 months and shows an uptick in the months since July. Compared to other industry projections, our Capital Spending results are somewhat more conservative on the 2023 outlook, but most industry economists agree the market will be down next year, if by lesser degrees.

Anecdotal evidence from this year’s International Manufacturing Technology Show (IMTS) and other consumer interactions suggest a stronger manufacturing sector than does Capital Spending. According to Pat McGibbon, chief knowledge officer of AMT – The Association for Manufacturing Technology, “Next year we will be down in the first half and likely see modest improvement in the second half of 23 through most of 2024.”

Spending on Swiss-types and other screw machines will continue growth trends.

The GBI aligns with that general view. It is a diffusion index much like the Purchasing Managers’ Index (PMI) that measures the pace of growth in the metalworking market. A score of 50 indicates a flat market, higher means a growing market and lower indicates a shrinking market. The GBI has been in positive territory almost since the beginning of 2017 (with a relatively short drop in the second half of 2019 followed by the COVID-19 drop in 2020) and posted an all-time high in 2021. The growth rate has been slowing for most of this year and is currently hovering near 50.

The Bright Spots

Despite the headwinds of an uncertain general economy, there are significant bright spots in capital spending in 2023. As it has been for the last few years, the job shop market will continue to grow and be far and away the largest market for machine tools with almost $2.5 billion in spending. In terms of total spending, the next largest markets will be industrial machinery ($900 million), aerospace ($600 million), and automotive ($500 million). Moreover, smaller plants (fewer than 100 employees) collectively will account for a majority of capital investment in many manufacturing categories.

In terms of growth, industries increasing spending next year include:

The medical industry is expected to increase spending on capital equipment next year.

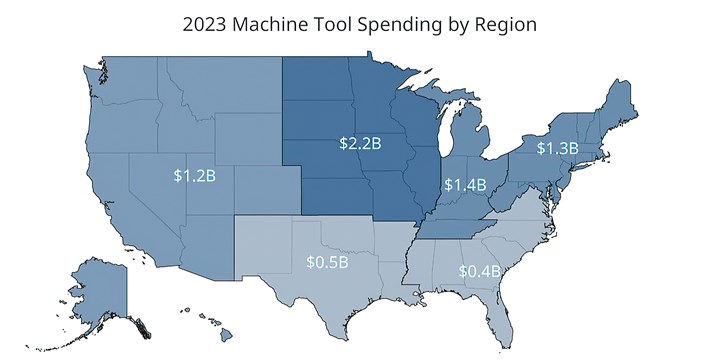

Geographically, the largest regions are north-central states with 31% of spending followed by the Midwest at 20%, the Northeast at 19%, and the West at 17%.

As for what manufacturers are buying, machining centers account for nearly 40% of capital spending in 2023. That is followed by turning centers (25%), grinding machines (9%), and EDM and screw machines, both at about 4%. While total spending on lathes and turning centers will be down next year by about 31%, spending on Swiss-type and other screw machines will continue growth trends over the last few years and be up about 33% in 2023.

There were other encouraging indicators from the Capital Spending Survey as well. For example, the percent of planned spending on new machines (versus used) remains at about 70%. In addition, the main objective cited for investing capital (unchanged from the last two years) is to improve productivity/efficiency. Increasing capacity is a growing reason for investing capital, which is generally an indicator of expected growth, particularly in the job shop market. Reducing costs is the one major objective that declined. Plus, while overall spending will be down next year, one indication that it might not be as dramatic a decline comes from responses to a sentiment question added to the Capital Spending survey. Specifically, some 45% of respondents said they would increase capital spending next year and another 29% said they’d spend about the same. Only 26% said they’d spend less.

Related Content

Sandvik Coromant Inserts Provide Stable Turning of Aerospace Components

The new insert grades GC1205 and GC1210 cover a large application area within last-stage machining and intermediate-stage machining when turning aerospace engine components.

Read MoreForkardt Hardinge Swiss Workholding Provides Reliable, Consistent Performance

The company’s Swiss collets are designed to securely hold parts without marring surfaces, minimizing vibration to ensure smoother machining, enhanced accuracy and extended tool life.

Read MoreJR Machine Launches Expansion Strategy, Hires New CEO

An investment from Schneider Resources Holding positions JR Machine to grow in emerging markets such space exploration and green energy.

Read MoreHow Small Machine Shops Can Fight Supply Chain Problems

Supply chain disruptions are still presenting challenges in manufacturing. This article examines the effects on aerospace, automotive and medical industries. It also covers ways that machine shops can be successful securing work despite the challenges created by the supply chain.

Read MoreRead Next

Vision Metrology for Medical

Understanding best practices and the options available with vision measurement systems is particularly important when inspecting complex medical components having stringent traceability requirements.

Read MoreGrowth Comes When Machining Challenges Are Met

Manufacturers such as SDP/SI that embrace machining challenges ultimately find ways to become more efficient and profitable operations.

Read MoreShop Shares Lights-Out Lessons Learned

Automated machining and data collection have helped Custom Tool to not only grow its business through more overnight production but also to establish a continuous improvement mindset that has enabled it to become more efficient in numerous areas.

Read More

.jpg;maxWidth=300;quality=90)